COVID-19 is making an adverse impact across the globe. Many countries are facing immense social and economic disruption. In less than no time, everything has changed and daily life will never be the same. The Banking industry has already started struggling with basic operations, workforce and customer engagement. On the other hand, many banks are experimenting with initiatives to tide over the challenges amid the crisis. Banks can minimize disruption and continue to offer customer services by pivoting to three imperatives – securing business survival, manage social responsibilities and adapting to the new normal. Let’s walk through how banking will look like after the pandemic.

Securing Business Survival

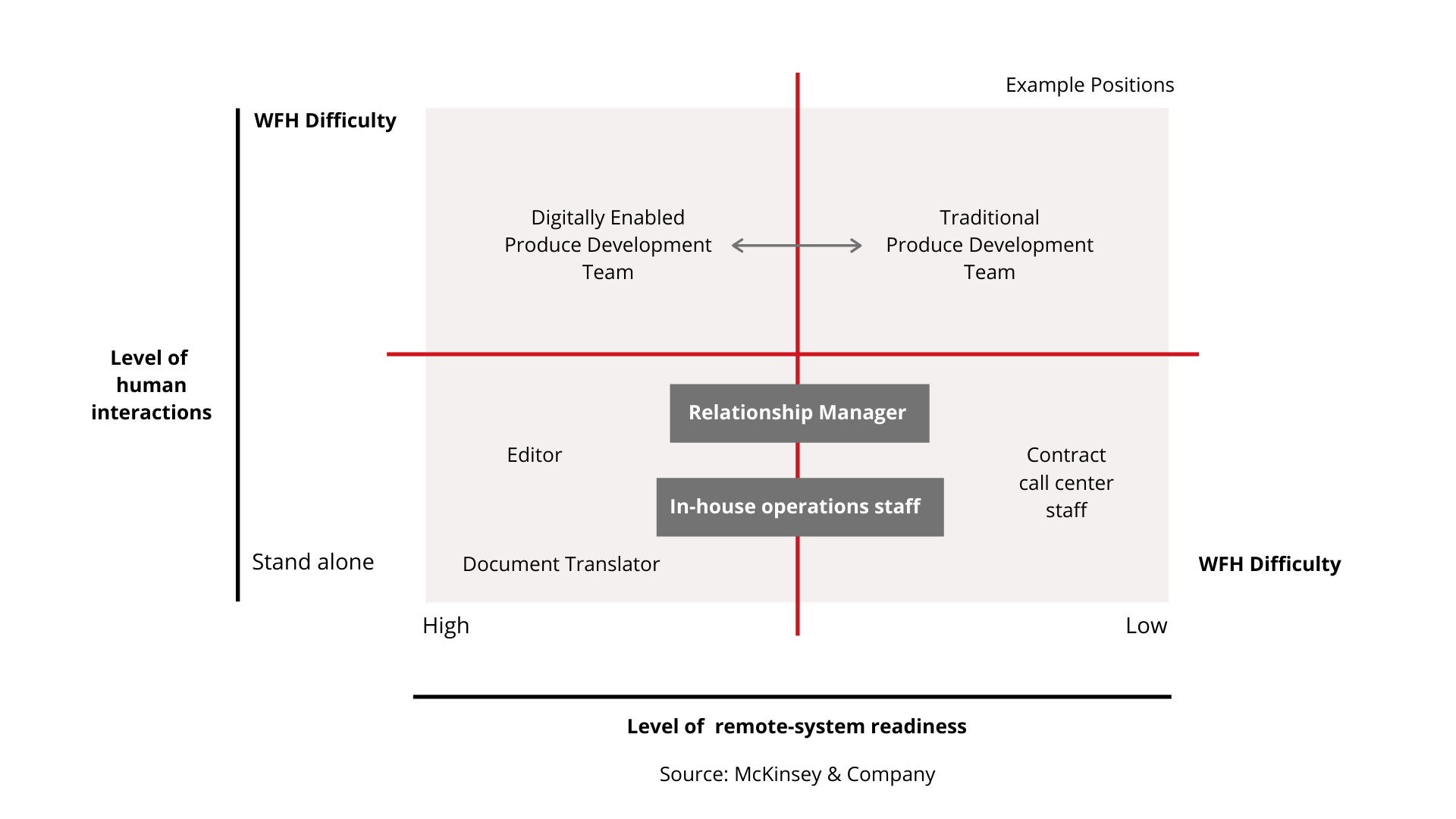

Concerning the impact of the pandemic, banks implement new approaches to overcome delay in basic operations. Their prime concern is to spot the issues in business continuity and experiment with modern solutions. Many of them will form a response-management unit composed of executive-level and cross-functional teams. To make smart key decisions and to respond quickly to future pandemics, these teams will be empowered across the organization. They are also adopting the remote working strategy, a move that requires IT support to ensure safe and secured infrastructure. Digitally enabled product development teams are well equipped to work from home in future compared with the traditional teams.

The pandemic forced banks to accelerate their transformation to adopt digital channels. Enabling contactless customer engagement is the main goal of banks now. For that, they not only leaned heavily on leveraging the existing digital channels but also planning to accelerate the process to digitize the complete core-banking system.

Managing Social Responsibilities

Banks have a huge social responsibility to support their customers and government efforts to cushion the economic impact of the current and future pandemic. They are currently in a position to gain customer trust and take proactive measures to help the most vulnerable customers. Plans to assist vulnerable customers with immediate financial relief are to be implemented to handle the pressing situation in the near future. Some financial institutions are sketching plans to provide additional products and value-added services such as pandemic insurance and an epidemic & medical information portal. It is expected that banks may involve in the development of applications that can provide access to various daily services such as food delivery, recipes and online courses for remote working employees.

Banks have a huge social responsibility to support their customers and government efforts to cushion the economic impact of the current and future pandemic. They are currently in a position to gain customer trust and take proactive measures to help the most vulnerable customers. Plans to assist vulnerable customers with immediate financial relief are to be implemented to handle the pressing situation in the near future. Some financial institutions are sketching plans to provide additional products and value-added services such as pandemic insurance and an epidemic & medical information portal. It is expected that banks may involve in the development of applications that can provide access to various daily services such as food delivery, recipes and online courses for remote working employees.

Adapt to the new normal

Now banks have taken action to tide over the initial waves of the pandemic. The next step is to turn their attention to functioning in a post-pandemic world. Consumers are rapidly adapting to the new situation. What they expect from their banks is different and this change is going to evolve in the post-pandemic world. As digital payment are rising every day, Banks will prioritize digital banking and payments in the near future to meet the challenges. To become stronger in the post-pandemic world, banks have to be prepared to facilitate this new normal. Speeding up mobile payments adoption and opening new digital onboarding capabilities will be the main concerns for all the banks.

Now banks have taken action to tide over the initial waves of the pandemic. The next step is to turn their attention to functioning in a post-pandemic world. Consumers are rapidly adapting to the new situation. What they expect from their banks is different and this change is going to evolve in the post-pandemic world. As digital payment are rising every day, Banks will prioritize digital banking and payments in the near future to meet the challenges. To become stronger in the post-pandemic world, banks have to be prepared to facilitate this new normal. Speeding up mobile payments adoption and opening new digital onboarding capabilities will be the main concerns for all the banks.

How Inspirisys can help?

Banks have no choice but to respond to both the current pandemic and the future pandemics quickly and decisively. Inspirisys helps banks to develop new digital strategies to be successful in the post-pandemic world. With over 28 years of experience and a brand that believes in evolving with time, we help in bringing digital disruption to the banking sector. Our remote-ready solutions such as cloud, enterprise security and infrastructure solutions, aid banks to sustain and excel in the post-pandemic world.