Today, Finacle powers banking operations in over 94 countries, supporting more than 848 million customers — that’s nearly 16.5% of the world’s adult banked population. As the financial services industry moves rapidly toward digital transformation, Finacle has emerged as a preferred core banking solution for modern banks. This powerful banking software suite enables institutions to upgrade their legacy systems and streamline operations — from transaction processing and loan management to customer engagement and omnichannel experiences.

But before we dive deeper into how Finacle is reshaping the banking landscape, here are a few questions to consider:

- How prepared is your bank for the digital shift?

- How can you improve customer experience and boost efficiency?

- What role can Finacle play in your bank’s future?

This blog explores everything you need to know about Finacle — from its core capabilities to why it’s trusted by leading banks across the globe. Use this guide to understand where Finacle can add real value to your technology roadmap and customer experience strategy.

What is Finacle?

Finacle is a modern core banking platform developed by Infosys that helps banks and financial institutions streamline operations, accelerate digital banking transformation, and deliver better customer experiences. Known for its flexibility and scalability, Finacle supports a wide range of banking functions — from account management, fund transfers, and lending operations to customer relationship management.

Designed for real-time processing and secure transactions, Finacle provides seamless integration across multiple channels, including mobile banking, online banking, and branch systems. It also helps banks strengthen their approach to risk management, regulatory compliance, and data analytics, enabling smarter decisions and more responsive service.

Finacle is used by both retail and corporate banks to simplify processes, reduce operational costs, and stay competitive in an increasingly digital financial landscape.

How Does Finacle Work

Finacle acts as a comprehensive digital banking platform, enabling real-time, secure communication between banks and external applications. It facilitates smooth data exchange while enforcing strict controls over data access and security.

Here’s a step-by-step overview of how Finacle supports secure data sharing:

1. Customer Authorization

The customer links their bank account to a trusted third-party app and provides consent to share specific financial data.

2. Secure Request Validation

The third-party app sends an encrypted request to the bank’s system. Finacle verifies the user’s identity using secure authentication methods such as multi-factor authentication.

3. Data Retrieval with Permission Control

Finacle accesses the authorized information from the customer’s account, strictly adhering to granted permissions and compliance standards.

4. Protected Data Transmission

The requested data is transmitted over an encrypted channel to the third-party app, enabling services like payment initiation, personal finance management, or account aggregation.

Key Features of Finacle

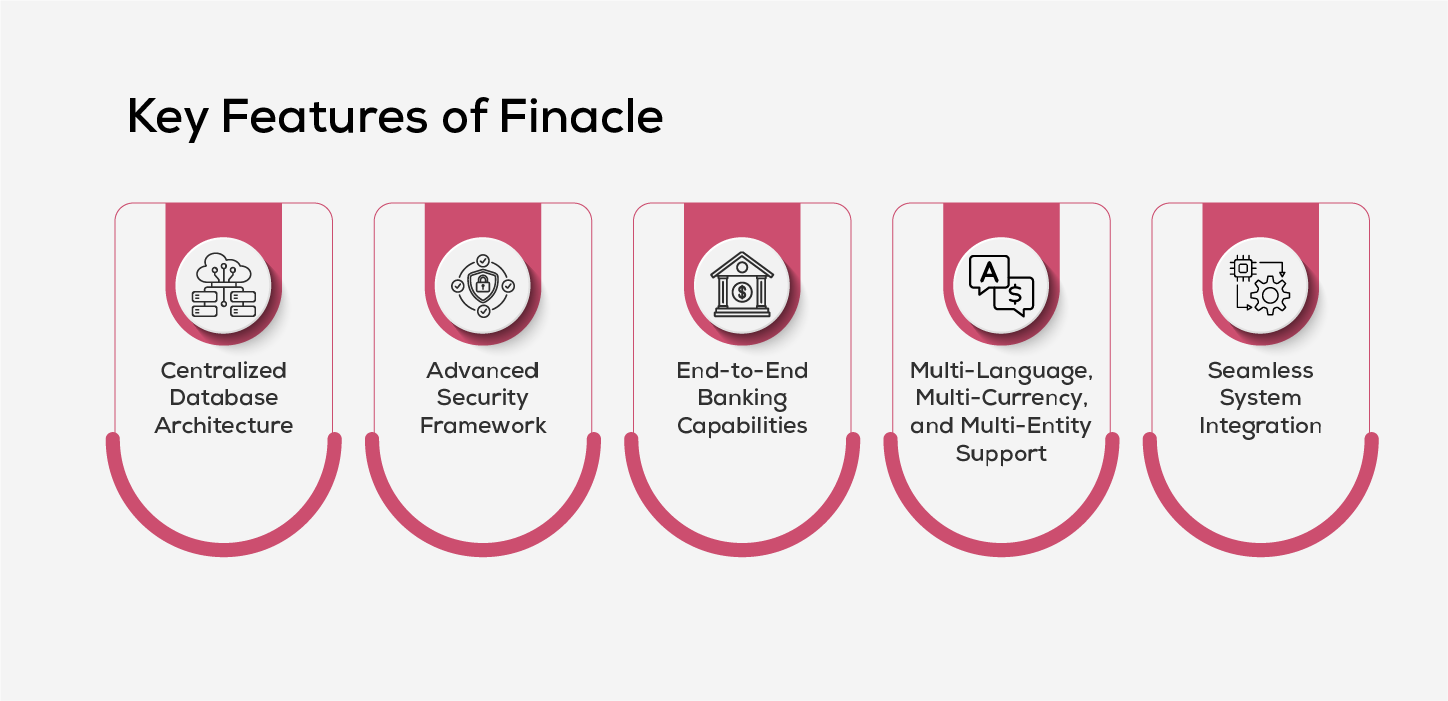

Finacle delivers functional depth and integration capabilities that go beyond traditional banking systems. These key features support future-ready operations, helping institutions lead in a competitive, customer-centric market.

1. Centralized Database Architecture

Finacle uses a centralized data management model, consolidating information from all branches into a single, secure data center. This helps banks simplify their operations by:

- Providing real-time data access across locations for faster service delivery

- Enhancing security by restricting access to authorized roles

- Automating data backups and disaster recovery for uninterrupted service

2. Advanced Security Framework

Security is deeply embedded in Finacle’s framework, ensuring the integrity and confidentiality of banking operations. Core security features include:

- Maker-Checker Workflows for dual control in transaction processing

- Detailed Audit Trails to monitor system usage and ensure accountability

- Role-Based Access Controls (RBAC) for managing user privileges securely

3. End-to-End Banking Capabilities

Finacle supports a wide range of banking functions, covering both retail and corporate domains. Key functional areas include:

- Retail Banking – For savings, loans, fixed deposits, and account management

- Trade Finance – Supporting letters of credit, remittances, and guarantees

- Wealth Management – Covering investment portfolios, syndicated loans, and advisory tools

4. Multi-Language, Multi-Currency, and Multi-Entity Support

Finacle enables global banking operations through features tailored for diverse markets. Its flexible framework supports:

- Multi-Language Support – Enhancing accessibility for users in different geographies

- Multi-Currency Functionality – Supporting real-time conversions with automated FX rates

- Multi-Entity Management – Managing subsidiaries and business units under one system

5. Seamless System Integration

Built with open architecture, Finacle ensures smooth interoperability with third-party solutions and enterprise systems. It allows:

- Unified customer view via a single Customer ID

- Integration with CRM, Loan Origination, and digital banking channels (ATMs, mobile apps, internet banking)

- Automated workflows for loans, account creation, and compliance reporting

Finacle Core Banking Solution for Modern Digital Banking

Finacle revolutionizes financial services with a flexible, cloud-ready platform that simplifies operations, accelerates innovation, and supports seamless digital adoption. Here's a closer look at the key banking solutions Finacle delivers across retail, corporate, and digital channels.

1. Core Banking Capabilities

Finacle’s core banking system is built for scalability, agility, and end-to-end automation. It supports a wide range of financial products and services, enabling banks to launch offerings quickly, adapt to market needs, and operate seamlessly across channels. With real-time transaction processing, embedded analytics, and open API architecture, Finacle helps banks deliver personalized, secure, and consistent experiences across the customer lifecycle.

2. Digital Engagement Suite

The Digital Engagement Suite by Finacle empowers banks to deliver consistent, omnichannel experiences across retail, SME, and corporate banking. It provides a unified interface for customers, staff, and ecosystem partners—enabling seamless onboarding, personalized service delivery, and enhanced digital engagement. Its API-ready and microservices-based architecture helps accelerate innovation and boost operational efficiency.

3. Corporate Banking Solution Suite

Finacle’s Corporate Banking Suite caters to the complex needs of large enterprises and institutional clients. It includes modules for corporate deposits, lending, payments, cash and liquidity management, and trade finance. Built on a flexible, cloud-ready platform with AI, blockchain, and open APIs, it helps banks streamline operations, reduce risk, and deliver tailored business banking solutions.

4. Cash Management Suite

The Finacle Cash Management Suite equips banks to deliver digital-first treasury and cash management services to their corporate customers. It offers capabilities like liquidity management, virtual accounts, real-time payments, and omnichannel corporate access—enabling banks to enhance cash flow visibility, increase operational control, and unlock new revenue streams.

5. Digital Lending

Finacle’s Digital Lending Suite streamlines the end-to-end lending lifecycle—from application and credit assessment to disbursement and collections. The cloud-native platform supports retail, SME, and corporate lending, offering automation, risk analytics, and seamless integrations to enhance approval speed, reduce defaults, and elevate borrower experiences.

Advantages of Finacle Core Banking Solution

Banks need agile, secure, and scalable solutions to meet growing customer expectations and regulatory demands. Finacle provides the technological foundation to help financial institutions adapt quickly, stay compliant, and deliver seamless customer experiences. Here are some of the key benefits that make Finacle a preferred choice:

1. Enterprise-Grade Security and Regulatory Compliance

Finacle provides a secure banking foundation with advanced encryption, multi-layered access controls, and adherence to global cybersecurity standards. Its cloud-ready architecture ensures strong data governance and enables banks to stay fully compliant while protecting sensitive financial information.

2. Open Banking Capabilities and API Integration

With robust open banking APIs, Finacle enables seamless integration with fintech ecosystems and third-party applications. This supports new digital revenue models, improves customer data sharing securely, and helps banks comply with evolving regulations.

3. Enhanced Operational Efficiency and Business Resilience

Finacle's modular core banking architecture streamlines operations across retail, corporate, and digital banking. Automated workflows, early IT risk detection, and rapid deployment through SaaS reduce maintenance efforts, enhance performance, and improve system uptime.

4. Omnichannel Digital Banking Experience

Finacle ensures a consistent user experience across digital and physical banking touchpoints. Through real-time data synchronization, customers can access their accounts and services seamlessly via mobile apps, internet banking, or in-branch interactions.

5. Custom Application Development and System Flexibility

Finacle allows banks to develop, extend, and customize applications without disrupting core systems. Its support for third-party integrations, microservices, and Service-Oriented Architecture (SOA) ensures scalability and responsiveness in a fast-changing financial environment.

6. Accelerated Financial Product Innovation

Finacle enables banks to launch new financial products and services tailored to different customer segments. With dynamic pricing, product bundling, and flexible deployment options, banks can respond quickly to market trends and enhance customer engagement.

7. Digital Assurance and Banking Software Testing

Finacle Testing Services provide automation, data migration testing, and business process validation, ensuring high-quality deployments and reduced time-to-market. This enhances reliability and supports banks in their digital transformation journey.

8. Increased Productivity and IT Efficiency

Finacle automates repetitive tasks, supports Straight Through Processing (STP), and eliminates data silos, reducing manual intervention and operational errors. This improves turnaround times, enhances branch productivity, and boosts overall performance across banking operations.

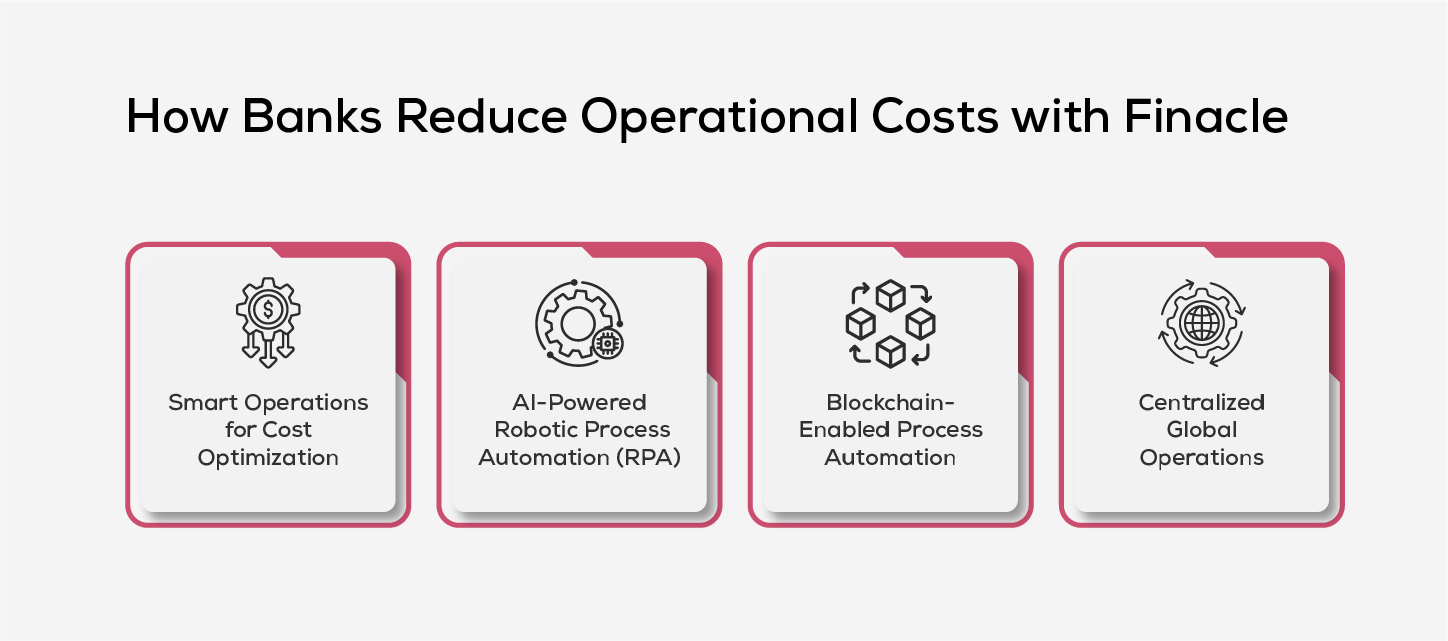

How Banks Reduce Operational Costs with Finacle

Banks are under constant pressure to deliver seamless services while keeping operational costs under control. Finacle empowers financial institutions to strike this balance through intelligent automation, AI integration, and process optimization. By minimizing manual interventions and streamlining workflows, Finacle significantly enhances operational efficiency and reduces overheads.

1. Smart Operations for Cost Optimization

Finacle leverages rule-based logic, API integrations, and business process management (BPM) tools to automate and orchestrate back-office operations. This reduces turnaround times, improves data accuracy, and enhances compliance. By eliminating manual dependencies, banks can optimize resources, reduce costs, and deliver faster, more reliable banking services.

2. AI-Powered Robotic Process Automation (RPA)

Finacle integrates seamlessly with AI-powered Robotic Process Automation (RPA) tools to drive intelligent automation. These bots handle high-volume, repetitive tasks such as loan processing, compliance verification, and reconciliation—reducing errors and improving process speed. By streamlining cross-system workflows, banks can free up staff for higher-value tasks and increase overall operational agility.

3. Blockchain-Enabled Process Automation

Finacle supports blockchain integration to enhance trust, transparency, and automation across multi-party transactions. Blockchain streamlines interbank processes such as trade finance, cross-border settlements, and digital identity verification—reducing fraud risk, eliminating intermediaries, and ensuring tamper-proof transaction records.

4. Centralized Global Operations

Finacle enables global and regional banks to consolidate their operations through centralized processing hubs. By streamlining functions like transaction management, regulatory reporting, and customer service across geographies, banks can standardize operations, reduce redundancies, and lower infrastructure costs—while delivering consistent service quality worldwide.

Finacle Deployment and Upgrade Solutions

Finacle enables banks to adopt digital transformation at their own pace, offering deployment options tailored to their specific operational models. Whether launching a digital-only bank, enhancing an existing ecosystem, or creating a "bank-in-a-bank" setup, Finacle provides a secure, scalable, and efficient rollout framework. Its transformation approach is anchored in three key foundations that minimize risk while accelerating value delivery.

1. Pre-Built Bank Model References

To fast-track implementation, Finacle offers pre-built bank model templates designed for both emerging and mature financial markets. These models come embedded with localized features—such as regional compliance requirements, workflows, and customer behavior insights—helping banks reduce deployment timelines while ensuring full regulatory alignment.

2. Incremental Deployment and Modular Upgrades

Finacle supports a modular deployment approach, allowing banks to implement specific components—like retail banking, payments, or lending—based on immediate priorities. This phased strategy ensures minimal disruption, faster adoption, and lower risk. Continuous, low-impact upgrades also enable institutions to keep pace with innovation without overhauling their entire ecosystem.

3. Agile Delivery Model

Finacle’s agile delivery model allows banks to go live with core functionalities quickly and expand features as business needs evolve. This approach shortens time-to-market, lowers initial investment, and enables rapid adaptation. Continuous iteration ensures that banks can respond to changing customer demands and regulatory shifts with minimal downtime.

Smarter Banking Ahead

As the banking industry faces rapid digital transformation, rising customer expectations, and tightening regulatory requirements, Finacle emerges as a critical partner for financial institutions ready to embrace the future. With its advanced technology and comprehensive core banking solutions, Finacle enables banks to streamline operations, enhance customer experiences, and maintain robust compliance.

By modernizing legacy systems and automating key processes, banks can improve efficiency and agility—crucial factors to staying competitive in today’s fast-changing market. More than just meeting today’s demands, Finacle equips banks to anticipate and adapt to future trends, helping them secure long-term growth and relevance.

In a world where smarter banking means faster innovation and better service, Finacle provides the tools and flexibility banks need to thrive—making it an indispensable asset on the path to digital excellence.

As a trusted Finacle partner, Inspirisys is here to help your institution leverage the full power of Finacle solutions. Get in touch with us today to explore how we can accelerate your digital banking transformation.

Frequently Asked Questions

1. Does Finacle offer cloud deployment?

Yes, Finacle delivers cloud-based deployment options, allowing banks to run their core banking operations on private, public, or hybrid cloud environments.

2. What is the difference between Finacle and Temenos?

Temenos focuses on efficiency, helping banks optimize operations and enhance customer service with modern technology. In contrast, Finacle offers a cloud-based platform with strong open banking capabilities, prioritizing security, streamlined integration, and digital transformation.

3. Is Finacle a CRM software?

While Finacle incorporates customer relationship management features, it is not a dedicated CRM software. Instead, it serves as a comprehensive banking solution that includes CRM-like functionalities to enhance customer engagement and service delivery. Banks often integrate Finacle with standalone CRM solutions to leverage a complete customer management experience.

4. Can Finacle be customized for different banking needs?

Yes, Finacle supports multi-entity, multi-currency, and multi-language capabilities, allowing banks to tailor the platform according to their operational requirements, regulatory environments, and customer demographics.