Quick Summary: Digital transformation in banking is driving smarter, faster, and more secure financial services. From automated onboarding to AI-powered engagement, banks are adopting real-time technologies to enhance operations and deliver seamless customer experiences. Yet, challenges like legacy systems and evolving compliance demands make strategic execution essential for success in a digital-first landscape.

The digital shift in banking is no longer just about convenience or speed. It completely rethinks how financial institutions operate, compete, and build lasting customer relationships. What began as isolated upgrades has become a continuous transformation focused on agility, accessibility, and intelligent decision-making.

Banks today are reshaping their strategies around customer behaviour, harnessing cloud technologies, artificial intelligence, and open ecosystems to stay relevant. The push toward digital banking is driven by innovation, rising expectations, and evolving compliance demands.

As per recent findings from Statista, global digital banks are expected to generate a net interest income of $1.61 trillion in 2025. This figure is projected to rise steadily at a CAGR of 6.8%, reaching $2.09 trillion by 2029. With China alone contributing over $528 billion in 2025, these figures highlight the profitability and growing dominance of digital-first financial models.

This blog presents an in-depth look at the digital banking market in 2025, covering the key trends, emerging insights, and strategies banks can adopt to stay ahead.

Key Drivers behind Digital Banking Transformation

Digital banking is evolving rapidly, shaped by both customer expectations and technological progress. The following factors continue to drive this transformation in 2025:

1. Rise in Smart Devices and Connectivity

Wider adoption of smartphones and high-speed internet has brought banking to customers’ fingertips. This always-on connectivity supports round-the-clock access, making mobile apps and digital platforms the preferred interface for financial services.

2. Shift Toward Customer-Centric Models

The modern banking model is built around the customer, not the product. Financial institutions are rethinking their services to deliver more personalized experiences, transparent communication, and faster resolutions. Customer expectations for seamless digital onboarding, real-time updates, and secure, frictionless channels have made experience the key differentiator.

3. Operating Model Evolution

To support digital transformation, banks are adopting flexible operating models based on their goals and maturity levels. Some integrate digital capabilities within existing operations at the leadership level. Others establish independent digital business units to manage digital-first initiatives. A growing number of institutions are building fully digital-native ventures with dedicated technology stacks and direct-to-consumer strategies. Each model allows banks to scale innovation and respond more effectively to market changes.

4. Infrastructure Modernization

Legacy systems can no longer support today’s dynamic banking needs. Upgrading core infrastructure enables real-time data processing, integration with APIs, and scalable digital solutions. A modern backbone improves operational agility and supports seamless front-end delivery.

5. Data-Driven Decision Making

Consumer data is the new currency in digital banking strategy. With advanced analytics, banks can track usage patterns, anticipate needs, and develop relevant products. From loan approvals to credit scoring, data insights drive smarter, faster, and more secure decision-making.

6. The Broader Push for Digital Maturity

The push for digital transformation in banking reflects a broader shift across industries. As sectors like e-commerce, IT, and even agriculture adopt digital-first models, financial institutions are under pressure to modernize, upskill teams, and deploy future-ready platforms.

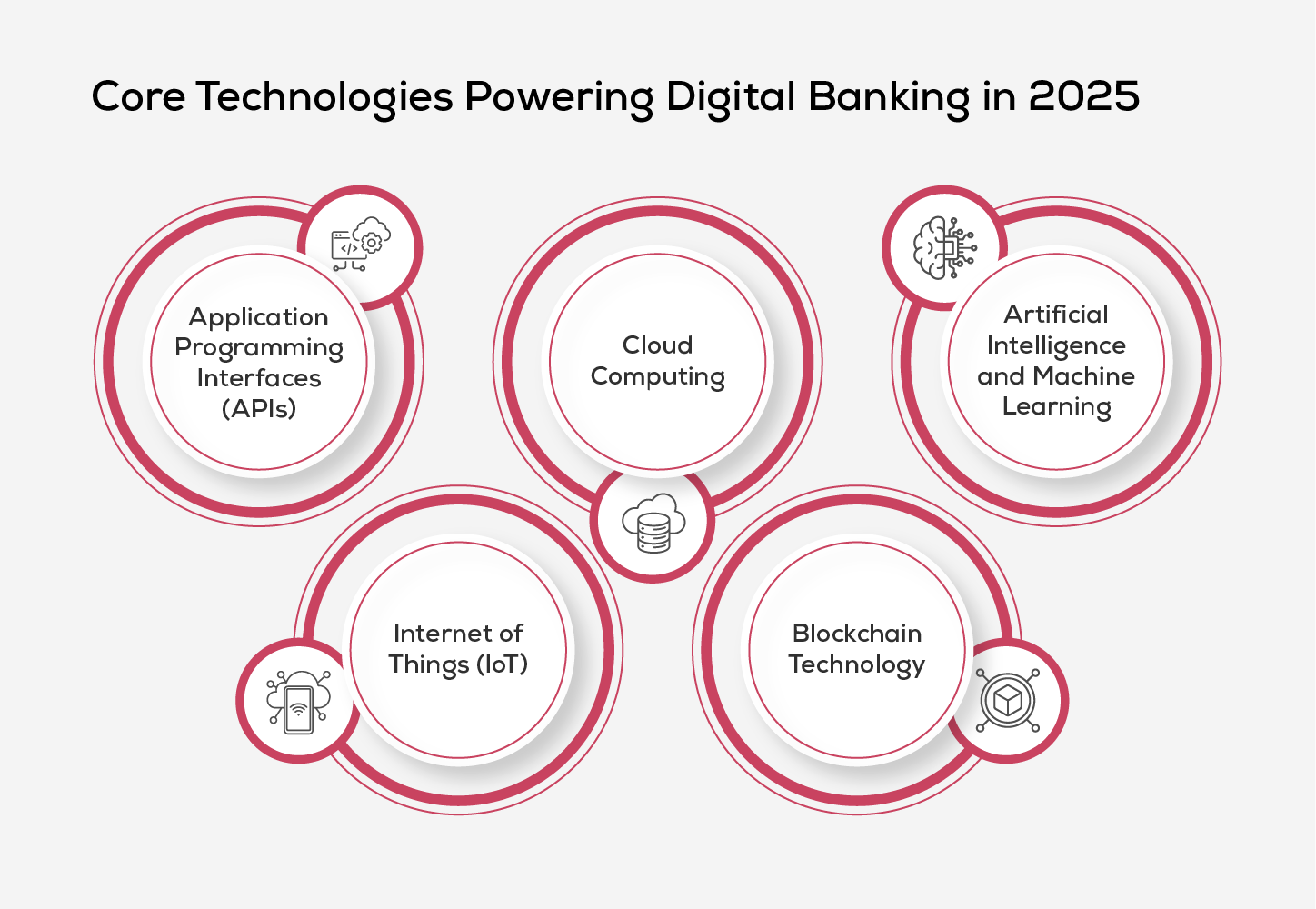

Core Technologies Powering Digital Banking in 2025

Digital transformation in banking is deeply tied to the adoption of advanced technologies that enhance efficiency and innovation. Financial institutions are increasingly relying on a modern tech stack to remain competitive and compliant. Below are the foundational technologies that continue to shape the digital banking ecosystem in 2025:

Application Programming Interfaces (APIs)

APIs act as digital bridges that allow software systems to exchange data and functionalities. In the banking sector, APIs facilitate seamless integration between internal platforms and third-party services, helping institutions launch new products, improve service delivery, and expand partnerships. They also support open banking initiatives by enabling secure access to customer data across multiple financial platforms.

Cloud Computing

Cloud technology has become a key enabler of agility and scalability in banking operations. By shifting to cloud infrastructure, banks can reduce dependency on physical servers, improve data accessibility, and ensure business continuity. Cloud-based platforms support rapid deployment of digital services, enhance data storage capacity, and provide the flexibility needed to adapt to market demands.

Artificial Intelligence and Machine Learning

AI and ML are central to the personalization and automation strategies of modern banks. These technologies analyze large datasets to deliver tailored experiences, automate repetitive tasks, and enhance decision-making. AI powers chatbots and virtual assistants that handle customer queries efficiently, while ML algorithms help detect fraud patterns, assess credit risks, and refine marketing strategies through behavioural insights.

Internet of Things (IoT)

IoT connects smart devices such as wearables and mobile sensors to banking systems, enabling real-time interactions and contactless services. This technology allows users to access account information, authorize payments, and manage transactions on the go. In addition, IoT contributes to advanced risk management and strengthens identity verification through biometric and contextual data.

Blockchain Technology

Blockchain brings transparency, traceability, and enhanced security to digital transactions. With its decentralized ledger structure, blockchain enables tamper-proof recordkeeping and faster cross-border settlements. Banks are leveraging this technology for secure data sharing, smart contracts, and customer authentication, reinforcing trust and compliance across operations.

Together, these technologies form the backbone of digital transformation in banking. They empower financial institutions to modernize operations, deliver customer-first experiences, and build resilience in an increasingly digital economy.

Digital Banking Vs. Online Banking: Understanding the Difference

While the terms "digital banking" and "online banking" are often used interchangeably, they represent different scopes of functionality within modern financial services.

Online Banking

Online banking delivers basic digital access to traditional banking services through a website or mobile app. Customers can check balances, transfer funds, download statements, and pay bills. However, because online banking is built as a digital overlay on legacy systems, it offers limited flexibility, slower service innovation, and primarily focuses on transactions and account access.

Digital Banking

Digital banking, on the other hand, is a broader transformation that reimagines banking operations from the ground up. It integrates advanced technologies like APIs, cloud platforms, and automation tools to build a fully digital ecosystem. This approach enables banks to offer real-time services, create personalized experiences, and streamline internal processes. Unlike online banking, digital banking supports end-to-end digital journeys, from onboarding to loan approvals, without the need for physical interaction.

In essence, online banking is a feature; digital banking is an entire framework. As financial institutions modernize, understanding this distinction becomes critical to evaluating long-term digital capabilities.

Best Practices for a Successful Digital Banking Transformation

The path to digital transformation in banking requires more than just technology upgrades. It involves strategic alignment, operational clarity, and a commitment to long-term change. The following best practices help ensure a structured and goal-driven transformation journey:

1. Define Clear Business Objectives

Begin with a focused vision of what the transformation should achieve. Identify business and technical goals that align with both short-term improvements and long-term growth.

Tip: Prioritize objectives that will deliver the most impact and revisit them as your digital strategy evolves.

2. Assess Existing Technology Ecosystem

Conduct a thorough evaluation of your current systems, tools, and platforms. Identify outdated or inefficient components that hinder performance or integration.

Tip: Document what works, what doesn't, and which systems are critical to ongoing operations. Factor in cost and scalability as part of the review.

3. Align Scope with Customer Needs

Use customer data and behavioural insights to shape your digital roadmap. Focus on services and experiences that matter most to your target audience.

Tip: Segment users based on digital adoption patterns and refine offerings to address specific pain points and usage preferences.

4. Set Realistic Priorities

Transformation doesn’t need to happen all at once. Balance ambition with available resources to create an achievable implementation roadmap.

Tip: Start with incremental goals and measurable outcomes. Early wins build momentum and improve internal buy-in.

5. Build a Strong Business Case

Ensure leadership is aligned by presenting a clear and data-backed case for transformation. Highlight both the operational improvements and customer value.

Tip: Tailor your business case to C-level stakeholders with projected ROI, risk mitigation plans, and a roadmap for execution.

By following these best practices, banks can navigate their transformation journey and unlock lasting value from their digital investments.

Benefits of Digital Transformation in Banking

Digital adoption in banking has unlocked a new set of strategic advantages beyond routine efficiencies. As the landscape matures, banks are using technology not only to enhance operations but also to build deeper, more meaningful customer connections. Below are additional benefits shaping the future of banking:

1. Customer-Centric Investment Services

Today’s investment platforms prioritize accessibility and responsiveness. By connecting institutional offerings with individual investors through a unified digital channel, banks can align their services more closely with customer profiles, short-term goals, and evolving expectations.

2. Automated Regulatory Support

Upgraded financial systems now embed compliance functions into daily workflows. Automated audits, cloud-based updates, and regulatory alerts reduce manual intervention, allowing teams to stay focused on critical outcomes while maintaining accuracy and control.

3. Expanded Market Reach

Digital-first environments give banks the visibility and reach needed to connect with wider audiences. With services available anytime and accessible through multiple channels, banks can attract new clients more easily and deliver consistent engagement.

4. Strengthened Information Security

Integrated security protocols built into modern platforms help safeguard sensitive financial data. From authentication layers to fraud detection systems, banks can offer customers peace of mind while meeting industry standards for data protection.

5. Precision-Driven Personalization

Banks now have the tools to understand and respond to individual financial behaviours in real time. By using customer insights effectively, they can offer relevant solutions and support continuous interaction throughout the customer lifecycle.

These benefits highlight how digital adoption is enabling banks to modernize specific functions, improve decision-making, and respond more effectively.

Challenges of Digital Transformation in Banking

Transitioning from traditional infrastructure to a fully digital banking model comes with several complexities. While the benefits are compelling, the path requires strategic alignment, technical upgrades, and enhanced risk management. Below are key challenges banks commonly face during this shift:

1. Legacy Infrastructure

Deeply embedded core systems are difficult to replace and expensive to maintain. Most were not designed for real-time processing or seamless integration, making them incompatible with modern digital frameworks. Retiring or upgrading these systems involves operational risk and requires careful redesign of core processes.

2. Rising Compliance Demands

Digital growth comes with increased regulatory oversight. Institutions must ensure adherence to data privacy laws, KYC norms, and AML standards across every digital channel. Without secure identity verification and transaction monitoring in place, compliance gaps can lead to reputational and financial consequences.

3. Cybersecurity Vulnerabilities

As banks expand their digital presence, they become more exposed to cyber threats. Attack surfaces increase, and customer data becomes a prime target. Without intelligent fraud detection and strong access controls, institutions risk losing trust and facing severe disruptions.

4. Stakeholder Misalignment

Digital transformation is an enterprise-wide initiative, but many programs stall due to misaligned priorities across leadership, IT, and business units. Without a clear business case, defined KPIs, and executive sponsorship, investments lack direction and fail to gain momentum.

5. Talent and Skills Gap

Banks often face shortages of digital talent skilled in AI, cloud, data science, and cybersecurity. This slows down transformation programs and increases reliance on third-party vendors. Upskilling internal teams while attracting specialized talent is critical for sustainable progress.

Overcoming these challenges requires a structured, phased approach. By aligning business and technology priorities, strengthening risk management, and building digital skills, banks can accelerate transformation while safeguarding long-term value and customer trust.

Real-Time Applications of Digital Transformation in Banking

Banks across the globe are embracing digital technologies not just to modernize operations, but to enhance customer experiences and deliver faster, smarter, and more secure services. Below are real-world use cases that reflect how digital transformation is being put into practice:

-

Seamless Digital Onboarding

Banks are replacing lengthy, paper-based application procedures with intuitive, AI-enabled workflows. Customers can now open accounts, verify identity, and submit documentation entirely online, reducing wait times and enabling faster activation of services.

-

AI-Powered Customer engagement

Virtual assistants and intelligent chatbots are becoming a staple across banking websites and apps. These tools can respond to customer queries in real time, retrieve account information, assist with credit assessments, and even suggest financial products based on user behaviour.

According to Deloitte’s 2025 Consumer Banking Survey, about 60% of users are engaging via chatbots for technical support and ~53% for account-related queries.

-

Personal Finance Management Through Mobile Apps

Banks are delivering enhanced mobile experiences that go beyond basic transactions. Customers can track spending patterns, set saving goals, receive bill reminders, and manage investments directly from their smartphones, putting financial control firmly in their hands.

McKinsey’s “Rewired for value” analysis finds that although many banks are investing heavily in digital transformation, only a subset captures large revenue or cost benefits: digital leaders are enjoying ~31% of expected revenue lift and ~25% of cost savings.

-

Enhanced Wealth Advisory with Automation

AI-driven robo-advisors are transforming wealth management by offering algorithm-based investment recommendations. These platforms allow users to explore portfolios, assess risk, and make investment decisions with minimal human input, bringing advisory services to a broader audience.

-

Biometric Authentication for Security

To reinforce trust and reduce fraud, many banks have adopted biometric security features. Fingerprint scans, facial recognition, and voice authentication are now being used to verify identity, streamline access, and safeguard sensitive transactions.

Conclusion

As banks advance their digital transformation initiatives, the focus is shifting toward sustainable outcomes, agile operations, seamless customer journeys, and efficient backend systems. Inspirisys Solutions Limited supports this evolution through robust core banking services, including tailored CBS implementations, real-time system integration, and expert consulting. Our capability to manage both technology and functional layers enables banks to transform at scale without compromising reliability. Whether it’s onboarding automation or platform migration, Inspirisys plays a key role in delivering measurable results.

Frequently Asked Questions

1. What does digitalization mean in banking?

Digitalization in banking means evolving systems, policies, and services to meet changing customer expectations. It involves adopting technologies while building a culture that supports agility and innovation.

2. What are the main areas of digital transformation in banking?

The key areas include customer experience, data analytics, operational efficiency, and business model innovation. This means delivering seamless digital interactions, using data to predict behavior and prevent fraud, automating operations through cloud and AI technologies, and introducing new offerings like blockchain-based services and peer-to-peer payment platforms.

3. What is the difference between digital banking and online banking?

Online banking refers to basic services like fund transfers and account access, while digital banking covers a broader range of tech-driven solutions, including automation, personalization, and end-to-end digital experiences. Online banking is just one part of digital banking.

4. How is digital technology used in banking?

Banks use digital technology to provide round-the-clock self-service, scale services through cloud platforms, make data-driven decisions, and enhance security and personalization using AI and machine learning.

5. What is the future of digitalization in banking?

Banking is expected to move toward platform-based models where collaboration with fintechs, regulatory tech, and data providers becomes standard. Instead of owning every process, banks will orchestrate ecosystems, offering modular services through APIs. Digitalization will also drive continuous product evolution, real-time compliance, and adaptive service delivery based on customer context and market shifts.