Evolution of Banking Compliance

Regulatory compliance has always been central to banking operations. What has changed is how compliance is interpreted, monitored, and proven.

About the Webinar

This on-demand webinar examines the evolution of compliance practices in banking, tracing how institutions moved from people-led oversight and manual controls to today’s digitally driven, regulator-monitored environment. The session brings together historical perspective and present-day regulatory expectations to explain why traditional approaches are no longer sufficient, and what banks must do to stay compliant now.

Key Takeaways

- A structured overview of compliance practices across four banking phases

- How automation changed the scale and scope of regulatory oversight

- Why siloed interpretation of regulatory directives creates risk

- The growing emphasis on proof-based and auditable compliance

- Regulatory expectations for centralised monitoring with distributed execution

The session offers practical clarity for institutions aligning with modern regulatory standards.

Why This Matters Now

Today, regulatory directives are digital, timelines are tighter, and accountability is non-negotiable. Yet many institutions still operate with fragmented processes and delayed responses.

This webinar explains why compliance must move beyond interpretation and reaction, toward structured execution supported by technology and governance.

Speaker

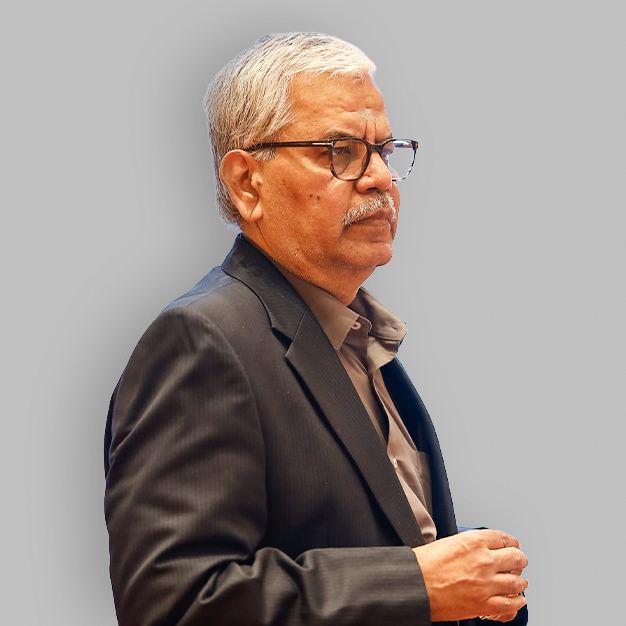

Mr. Durai Rajasekar (DR)

Banking Initiatives Advisor - Inspirisys Solutions Limited

Mr Durai Rajasekar is the Advisor of Banking Initiatives at Inspirisys Solutions Limited. With over four decades in the banking sector, he offers a rare longitudinal view of compliance from physical audits to regulator-driven digital oversight.

Continue the Conversation

Explore how modern compliance models are helping banks move from interpretation to execution.