Quick Summary: As banks prioritize modernization, open source core banking solutions are emerging as a viable path forward. These platforms provide freedom to customize, reduce costs, and innovate at speed. Still, the shift demands clear governance, legal clarity, and technical readiness. When thoughtfully implemented, open source helps banks build secure, scalable, and future-ready infrastructures.

Open source core banking software is steadily gaining traction as banks seek more control, agility, and alignment with evolving digital strategies. Unlike proprietary systems, these platforms offer financial institutions the flexibility to tailor their technology stack to specific operational and regulatory needs.

Today, both traditional and digital-first banks are embracing open source not just as a developer’s preference, but as a strategic lever for modernization. This article explores what open source core banking entails, why adoption is accelerating, and how banks can evaluate its role in driving their transformation journey.

Understanding Open Source Core Banking

Open source core banking systems are technology frameworks that allow financial institutions to access, modify, and distribute the source code freely. This flexibility enables banks to design critical functions such as customer account servicing, payments processing, and compliance workflows based on their unique requirements.

Typically maintained by global developer communities and industry-backed foundations, these systems promote transparency, collaboration, and continuous innovation across the financial technology ecosystem.

How Open Source Differs from Proprietary Banking Software?

Banking software is the structural layer that governs process execution, risk management, and the pace of innovation reaching the market. The model a bank selects, open source or proprietary, determines how technology is built, maintained, and scaled over time.

Open source software is defined by transparency and collective development. Banks gain visibility into the code, the ability to extend or refine features, and the support of a global community contributing improvements. This approach reduces reliance on a single vendor and provides greater scope for alignment with regulatory or operational priorities.

Proprietary software, on the other hand, is controlled by a single provider. Institutions access it through licenses, with modifications and upgrades typically determined by the vendor’s roadmap. While this model often includes dedicated support and tested stability, it can restrict customization and result in higher costs over time.

Here’s a quick comparison:

| Aspect | Virtualization | Containerization |

|---|---|---|

| Cost | Generally free with no licensing fees. | Requires license purchases and support contracts |

| Customization | High – Source code access allows extensive tailoring | Limited – Custom changes depend on vendor support. |

| Security | Transparent code enables peer-reviewed fixes | Vendor-managed security and certifications |

| Support | Backed by global developer communities and forums | Dedicated vendor support with SLAs |

| Ownership | Full control over implementation and updates | Vendor retains control of features and releases |

Both approaches come with distinct strengths and limitations. The decision depends on a bank’s priorities, whether it values agility and control or prefers turnkey solutions with vendor-managed support. While each model has its place, open source is increasingly gaining traction among institutions looking for adaptability, cost efficiency, and innovation-focused ecosystems.

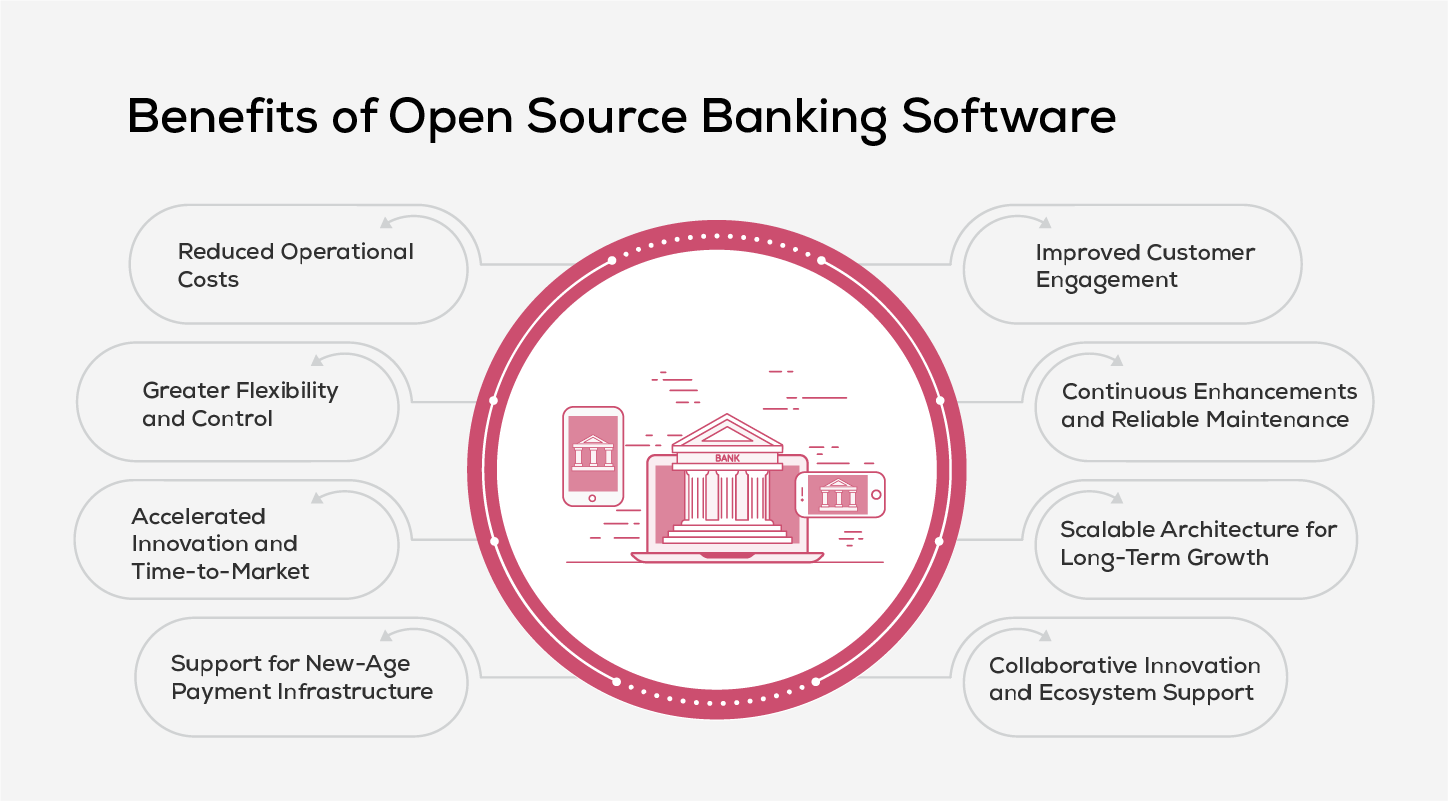

Benefits of Open Source Banking Software

The shift toward open source banking platforms is reshaping how financial institutions design, manage, and scale their digital capabilities. Here are the key benefits banks can realize with open source adoption:

1. Reduced Operational Costs

Open source eliminates licensing fees and minimizes vendor lock-in, lowering total cost of ownership. Banks can allocate resources more efficiently by investing in development and customization rather than recurring software costs. For smaller and digital-first institutions, this affordability accelerates digital adoption without overstretching budgets.

2. Greater Flexibility and Control

With full access to the source code, banks can customize features, user interfaces, and compliance frameworks to meet specific regional and operational requirements. Unlike proprietary systems that restrict customization, open source platforms allow complete control over how the software evolves, whether it's integrating with legacy systems or adapting to regulatory updates.

3. Accelerated Innovation and Faster Deployment

Global community contributions speed up feature development, security patches, and integrations. Banks can release new services or updates more quickly than traditional vendor-driven cycles, gaining an edge in delivering modern customer solutions.

4. Readiness for Emerging Payment Models

Open source platforms integrate easily with APIs, blockchain protocols, and digital wallets, helping banks adapt to new fintech ecosystems and evolving customer preferences without legacy constraints.

5. Improved Customer Engagement

A modular and configurable architecture allows banks to design more personalized and responsive user experiences. From real-time financial insights to tailored product recommendations, the platform can be continuously refined to serve diverse customer segments more effectively.

6. Continuous Enhancements and Reliable Maintenance

Regular contributions from a global developer base ensure that updates, bug fixes, and patches are released swiftly. This shared responsibility model promotes a more secure, resilient, and up-to-date environment compared to vendor-dependent proprietary systems.

7. Scalable Architecture for Long-Term Growth

Most open source platforms follow a modular design, making it easy to scale operations or add new features over time. Whether expanding to new geographies or launching digital-only subsidiaries, the architecture supports growth without the burden of major reconfigurations.

8. Collaborative Innovation and Industry Alignment

Banks participating in open source communities benefit from shared learnings and co-development opportunities with other institutions, fintechs, and developers. This fosters alignment with industry trends and allows quicker adoption of tested, peer-reviewed solutions.

These benefits collectively highlight how open source is strengthening the foundation of modern banking environments.

Challenges of Using Open Source Banking Software

While open source banking platforms offer several advantages, they also come with challenges that banks must navigate carefully. Understanding these risks is essential for successful implementation and long-term sustainability.

1. Data Privacy Risks from Integration Vulnerabilities

Open source systems often involve external integrations with APIs and third-party platforms. Without robust security protocols and access controls in place, these connections can become points of intrusion, exposing sensitive financial data. Failure to safeguard customer information can lead to privacy violations, loss of trust, and regulatory action.

2. Compliance Complexities in Highly Regulated Environments

Banking operates under strict regulatory frameworks, especially concerning customer data protection, financial reporting, and cybersecurity. Open source tools may not come with built-in compliance guarantees, leaving it to the institution to ensure alignment with standards like PCI-DSS, GDPR, or local banking laws. Oversights or misconfigurations could result in legal penalties or reputational damage.

3. Dependency on Community Involvement

The sustainability of an open source platform depends heavily on an active and engaged developer community. If development slows down or the project loses contributors, the software may face delays in updates, unpatched vulnerabilities, or even abandonment. For banks relying on such platforms, this could disrupt operations and demand costly in-house support to maintain continuity.

Open source banking software opens doors to innovation and agility, but overlooking these risks can lead to operational setbacks and compliance failures.

Key Considerations Before Adopting Open Source in Banking

Adopting open source banking software goes beyond a technical shift, it demands strategic planning and due diligence. Here are critical factors banks must evaluate to ensure successful deployment and long-term value:

1. Evaluate Internal Capabilities and Expertise

Banks must assess whether their IT teams have the technical knowledge to manage, customize, and maintain open source platforms. Without the right skill set, ongoing maintenance and troubleshooting can become a challenge, leading to increased dependence on external consultants or delayed issue resolution.

2. Establish Clear Governance and Risk Frameworks

IT and leadership teams must implement structured oversight to manage version control, access rights, and security updates effectively. Defining roles, assigning responsibilities, and setting escalation paths ensures consistent operations and minimizes risks from unmanaged code or integration issues.

3. Review Licensing Terms and Legal Compliance

Open source licenses vary in their terms and restrictions. Banks need to understand the implications of models such as GPL, MIT, or Apache, particularly regarding modifications, redistribution, and commercial use. Addressing compliance early avoids legal or reputational consequences.

4. Plan for Long-Term Support and Continuity

Sustainability depends on the strength of the developer community and frequency of updates. Banks should plan contingencies, either through commercial vendor partnerships or internal capabilities, to ensure ongoing patching, enhancements, and stability.

5. Align with Regulatory and Security Standards

Customization must not compromise compliance. Before adoption, banks should confirm that the platform supports encryption, access controls, logging, and auditing to satisfy applicable regulations and safeguard sensitive data.

Open-Source Banking and Its Beneficiaries

Open-source digital banking platforms are creating new opportunities across different layers of the financial ecosystem. Listed below are the beneficiaries who stand to gain the most from this collaborative and transparent approach to financial technology.

- Developers

Open access to core banking frameworks empowers developers to customize functionalities, address niche requirements, and drive continuous innovation across financial products and services.

- Underserved Communities

By reducing licensing costs and supporting lightweight deployment, open-source solutions expand access to banking in underserved regions. This fosters financial inclusion where traditional infrastructure is limited.

- End Users

Customers gain access to a broader range of customizable digital tools for budgeting, saving, investing, and beyond, offering greater convenience, control, and personalization in managing their finances.

As adoption accelerates, open-source banking extends these advantages across the sector, enabling more inclusive and adaptable digital banking experiences.

Leading Banks Using OpenSource Software

Several leading global banks are increasingly turning to open source software to modernize their technology infrastructure and accelerate digital innovation. Institutions like JPMorgan Chase, Goldman Sachs, HSBC, Citi, Lloyds Banking Group, and Capital One have established dedicated Open Source Program Offices (OSPOs) to formalize their involvement in open source initiatives. These programs help banks collaborate with the developer community, streamline internal governance, and build more adaptable, scalable solutions.

This growing reliance on open source software also signals a shift in how banks approach collaboration and technology adoption. Instead of building everything in-house, institutions are now contributing to shared platforms that promote interoperability and continuous improvement. This approach not only fosters cross-industry partnerships but also supports more sustainable and future-aligned development practices in banking.

Popular Open Source Banking Software Platforms

A number of open source platforms are empowering banks and financial institutions to operate with greater flexibility, scalability, and cost-efficiency. Here are some of the most widely adopted solutions in the open source banking landscape:

1. Cyclos

Developed by the Social Trade Organisation (STRO), Cyclos is a robust open source banking platform supporting microfinance institutions, retail banks, and complementary currency systems. Its modular architecture, regular updates, and availability in both free and enterprise versions make it a versatile choice for institutions seeking adaptability with low overhead.

2. Mifos X

Mifos X is a modular, customer-centric platform designed to manage credit, savings, and loan products efficiently. Supporting cloud, on-premise, and offline deployments, it is well-suited for banks, credit unions, SACCOs, and lending firms. Licensed under MPL 2.0, it allows customization while ensuring compliance and operational consistency across branches.

3. MyBanco

MyBanco delivers high performance with the ability to process up to 1,500 transactions per second. Designed for financial institutions requiring precision and reliability, it provides detailed transaction logging and strong core banking functions. As a cost-effective alternative to proprietary systems, it combines scalability with rigorous financial controls.

4. OpenCBS

Initially launched as Octopus for microfinance, OpenCBS has evolved into a comprehensive core banking system. It supports loan management, collections, and CRM, while offering customizable workflows and an intuitive interface. With a cloud-hosted version on AWS, it ensures quick backups, seamless recovery, and smooth integration with other banking systems.

Conclusion

Open source banking software offers a strategic pathway to building agile and resilient digital infrastructures. By adopting open systems, banks can stay responsive to evolving market dynamics while maintaining control over their technology environment.

Effective adoption depends on clear objectives, structured planning, and a culture of continuous improvement. Active participation in the open source community and alignment with industry advancements will further drive innovation and sustainable growth in the sector.

Frequently Asked Questions

1. Who maintains open source software?

Open source software projects are built and maintained by a network of programmers, who may often be volunteers, and are widely used in free as well as commercial products.

2. Is open source software secure enough for banking?

Yes, when implemented correctly. Open source allows for rigorous code review, but banks must ensure proper configuration, regular updates, and compliance with security standards.

3. Can open source platforms integrate with existing banking systems?

Most open source platforms support modular integration through APIs, allowing them to work alongside legacy systems or third-party applications.

4. How does open source banking software support digital transformation?

It enables faster innovation, cost-effective scaling, and greater flexibility, allowing banks to modernize operations without being tied to vendor-specific solutions.

5. Do open source platforms help in meeting compliance requirements?

They can, but compliance depends on how the platform is configured. Banks must ensure it includes features like audit trails, encryption, and access control aligned with regulatory standards.