Evidence-Based Compliance in Banking

This episode spotlights two essential pillars of effective compliance: accountability and evidence. Here, Mr. Durai Rajasekar explains how Komply360 creates clear ownership across teams and ensures that every regulatory action is traceable, documented, and audit-ready. The conversation highlights how the platform supports banks in presenting structured proof during regulatory reviews, underpinning the idea that modern compliance depends as much on demonstrable evidence as it does on internal processes.

The discussion then moves to usability. DR shares the thinking behind the product’s interface and how it was designed to simplify daily work for compliance teams operating under constant pressure. He also outlines the platform’s direction as regulations evolve, including the approach of pre-building compliance obligations vertically, with a focused emphasis on the BFSI sector, along with further enhancements to strengthen its relevance and long-term value for banking institutions.

We are looking at pre-building compliance obligations by industry vertical. For now, our focus is on the BFSI vertical, that itself is a huge universe.

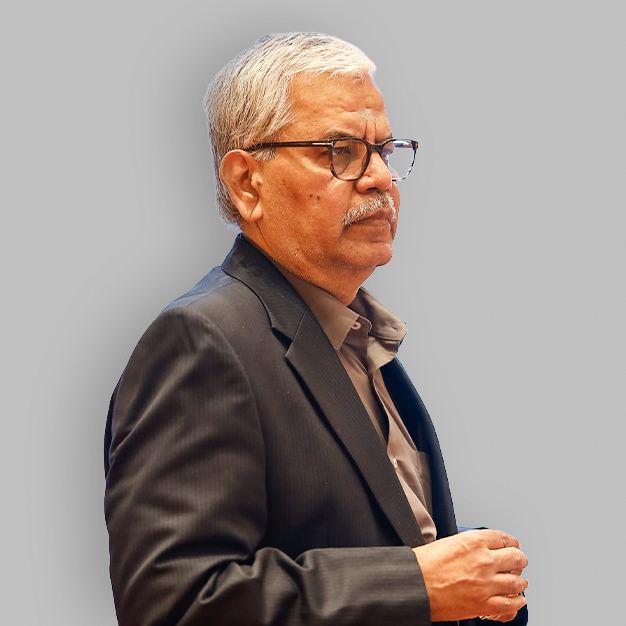

Today's Guest

Mr. Durai Rajasekar

Mr. Durai Rajasekar is the Advisor of Banking Initiatives at Inspirisys Solutions Limited. With over four decades in the banking sector, he offers a rare longitudinal view of compliance from physical audits to regulator-driven digital oversight.

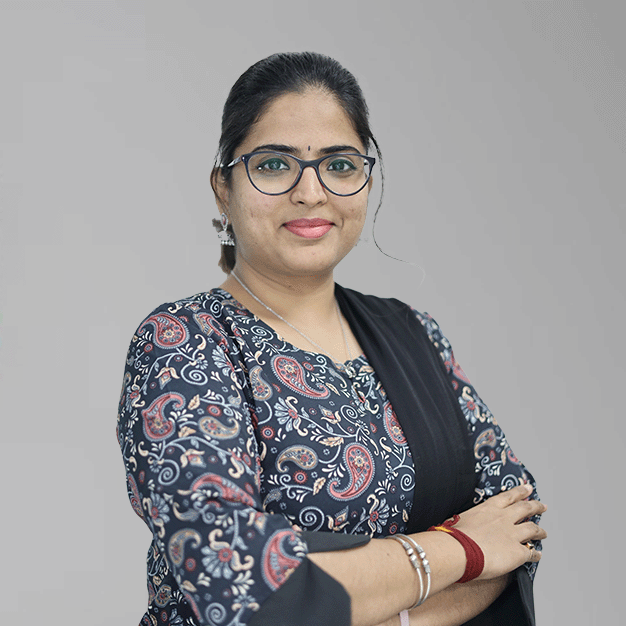

Today's Host

Yamini G

Yamini G is the Content Lead at Inspirisys, with a strong passion for writing. She collaborates closely with the marketing team and plays an active role in creating branding content. Yamini also engages with organizational experts to gain insights on various projects, bringing those ideas to life through her writing and engaging interviews.