To maintain trust and stability in the financial system, regulatory compliance plays a central role in banking operations. Banks are required to establish strong, compliance programs to safeguard stakeholder confidence and support the overall integrity of the financial ecosystem.

Failure to meet regulatory requirements can lead to significant penalties, operational disruption, and long-term reputational damage. As regulatory expectations continue to evolve, banks must clearly understand the compliance challenges they face and identify effective strategies to address them. This is where technology, particularly AI-driven solutions, is increasingly becoming a practical enabler.

This article examines the major regulatory compliance challenges in banking and highlights how AI-based approaches are being used to manage them more efficiently.

What is Compliance in Banking?

Compliance in banking refers to the policies, procedures, and systems that ensure a financial institution operates in accordance with applicable laws, regulations, and industry standards.

Compliance functions are typically overseen by dedicated teams responsible for maintaining internal controls, monitoring regulatory requirements, and ensuring employees are informed of compliance obligations. This includes overseeing key regulatory areas such as Anti-Money Laundering (AML), Know Your Customer (KYC), and Counter-Terrorism Financing (CTF). To support effective governance, compliance teams establish clear roles and accountability, maintain accurate documentation, and ensure transparent reporting to regulators. These practices help banks demonstrate regulatory adherence while maintaining trust with customers, shareholders, and supervisory authorities.

How AI is Changing Compliance in Banking?

AI is increasingly used in banking compliance to handle scale, speed, and complexity that manual and rule-based systems struggle to manage. By analysing large volumes of transactional, customer, and regulatory data in near real time, AI helps compliance teams move from periodic checks to continuous oversight.

Instead of replacing regulatory controls, AI strengthens them by improving accuracy, reducing manual effort, and supporting faster decision-making across compliance functions.

Key ways AI supports banking compliance include:

- Continuous transaction monitoring

Machine learning models analyse transactions as they occur, flagging unusual patterns that may indicate money laundering or fraudulent activity, rather than relying solely on post-event reviews. - Improved customer due diligence

AI accelerates KYC processes by validating customer information, identifying inconsistencies, and updating risk profiles as new data becomes available. - Risk prioritisation

AI helps compliance teams focus on higher-risk cases by ranking alerts based on likelihood and impact, reducing false positives and manual backlogs. - Automated document analysis

Natural language processing is used to review policies, contracts, and regulatory documents, extracting relevant information and supporting faster compliance checks. - Regulatory change tracking

AI tools scan regulatory updates and map changes to existing policies and controls, helping banks respond more quickly to evolving requirements. - Audit support and evidence management

AI assists in maintaining audit trails by organising data, validating records, and highlighting gaps before formal audits take place. - Operational efficiency

By automating repetitive compliance tasks, AI allows teams to spend more time on investigation, interpretation, and regulatory engagement.

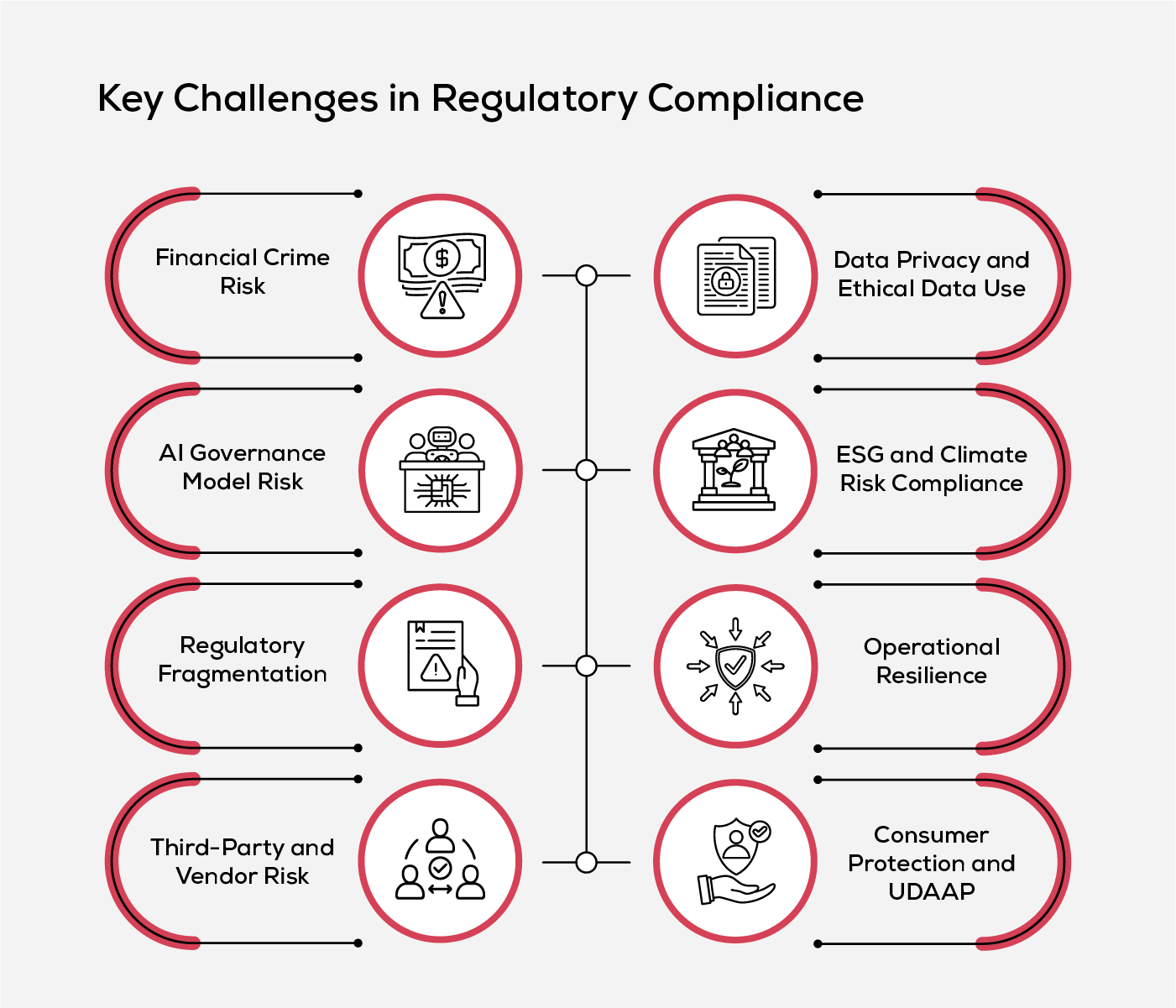

Challenges in Compliance

Banking compliance is shaped by digital change, global instability, and increasingly complex financial crimes. For compliance leaders, the job has moved past simple auditing, the role has expanded beyond periodic audits to managing continuous risk across technology, data, and operations. The following challenges define the current compliance landscape for banks.

Financial Crime Risk

Financial crime continues to evolve in scale and sophistication, making detection increasingly difficult. Criminals exploit digital channels, layered transactions, and complex ownership structures to conceal illicit activity, often operating below traditional detection thresholds.

This creates a challenge for banks because legacy monitoring systems generate high volumes of alerts with limited accuracy. When genuine risks are missed or investigations are delayed, banks face enforcement actions, financial penalties, and heightened regulatory scrutiny.

AI Governance Model Risk

The growing use of AI in compliance introduces new governance challenges. Automated models influence decisions such as fraud detection and customer risk scoring, which regulators expect to be transparent, explainable, and fair.

Without strong model governance, banks risk deploying systems that produce biased outcomes or cannot be adequately explained during audits. This can result in regulatory findings, restrictions on AI use, and loss of supervisory confidence.

Regulatory Fragmentation

Banks operating across regions must comply with regulations that often differ or conflict between jurisdictions. Variations in data protection, sanctions, and consumer protection rules make it difficult to apply consistent compliance controls across markets.

New mandates such as the U.S. Consumer Financial Protection Bureau’s Rule 1033 further add to this complexity by requiring secure consumer data sharing, often through APIs. If regulatory fragmentation is not managed effectively, banks risk reporting inconsistencies, localized compliance breaches, and costly remediation efforts.

Third-Party and Vendor Risk

As banks rely more on cloud services, fintech partners, and outsourced providers, compliance risk increasingly extends beyond the organization’s direct control. A weakness in a vendor’s systems or processes can quickly become a regulatory issue for the bank.

Inadequate third-party oversight exposes banks to regulatory penalties, operational disruptions, and accountability gaps, even when the failure originates outside the institution.

Data Privacy and Ethical Data Use

Banks handle large volumes of sensitive customer data, making compliance with privacy regulations increasingly complex. Balancing legitimate business use of data with regulatory expectations around consent and protection is a persistent challenge.

Misuse or mishandling of customer data can result in enforcement actions, financial penalties, and long-term erosion of customer trust.

ESG and Climate Risk Compliance

Regulators now require banks to assess and disclose climate-related and ESG risks within their portfolios. This involves new data sources, evolving reporting standards, and long-term risk modelling.

Inaccurate or unsupported ESG disclosures can expose banks to regulatory sanctions, accusations of greenwashing, and reputational damage in both investor and public markets.

Operational Resilience

Regulatory focus on operational resilience requires banks to demonstrate their ability to continue critical services during severe disruptions. This includes cyber incidents, system outages, and failures within third-party ecosystems.

Inadequate resilience planning can lead to service disruptions, regulatory intervention, and systemic risk concerns, particularly for large or interconnected institutions.

Consumer Protection and UDAAP

Regulators continue to scrutinize unfair, deceptive, or abusive practices, particularly around fees, disclosures, and customer communications. Compliance in this area requires consistent oversight across products and channels.

Failure to address UDAAP risks can result in enforcement actions, mandated customer remediation, and damage to brand credibility.

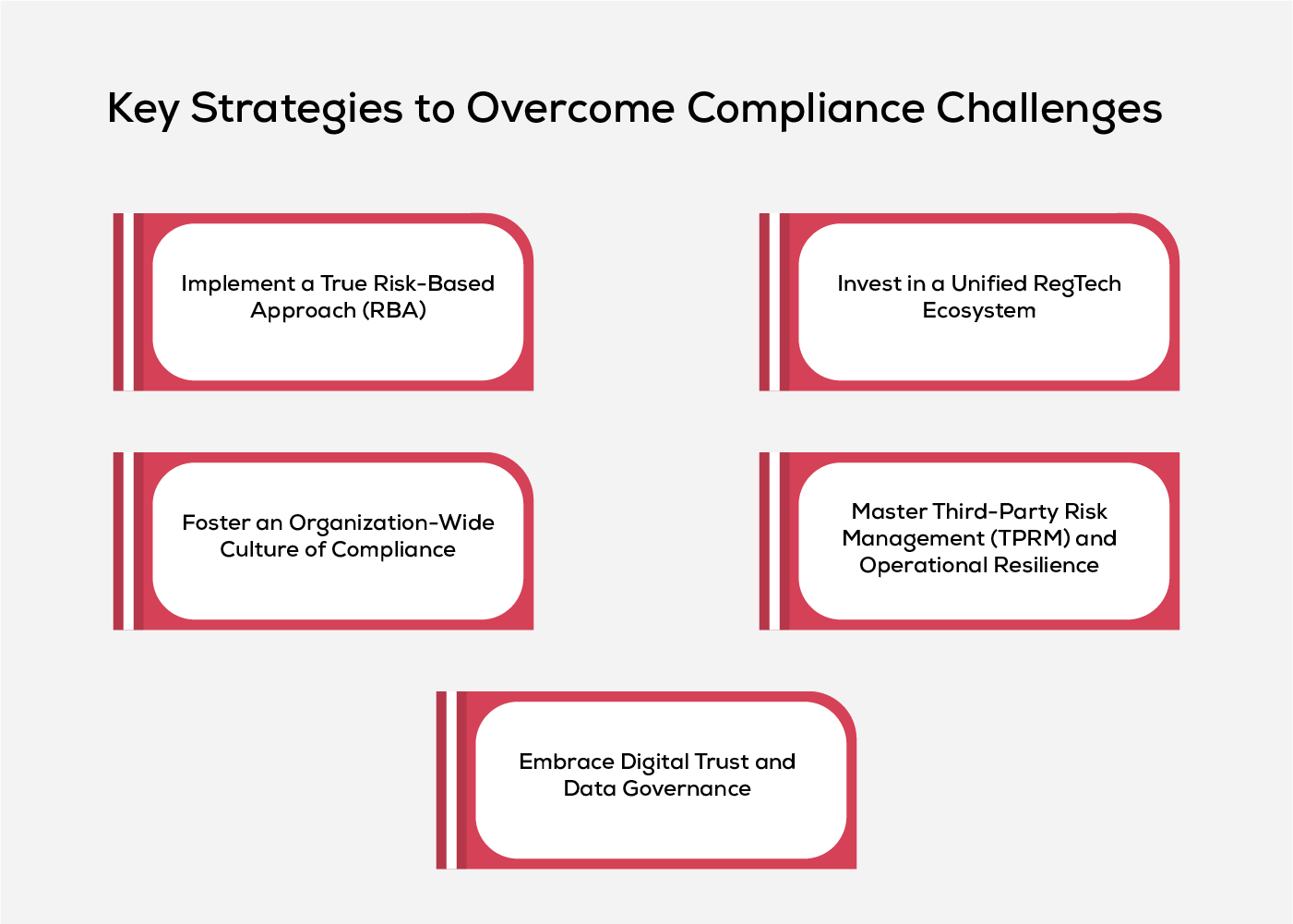

Key Strategies to Overcome Compliance Challenges

Addressing the scale and complexity of compliance landscape requires a fundamental shift from a siloed, manual, and reactive approach to an integrated, tech-enabled, and proactive strategy.

1. Implement a True Risk-Based Approach (RBA)

To ensure compliance efforts are effective, Dynamic Risk Assessments should be done beyond simple annual checks. Banks need to implement automated, continuous risk assessments that immediately flag shifts in customer risk profiles, such as those caused by adverse media reports or big changes in transaction volume. This continuous intelligence allows institutions to Prioritize Resources, directing compliance and investigation efforts primarily toward the highest-risk customers, suspicious transactions, and critical regulatory domains. This approach efficiently frees up staff and resources that would otherwise be wasted on low-value activities.

2. Invest in a Unified RegTech Ecosystem

To effectively leverage technology, abandon siloed, point solutions in favor of Integrated Platforms. This means adopting a unified system that combines AML (Anti-Money Laundering), KYC (Know Your Customer), sanctions screening, and regulatory mapping, ensuring data consistency and establishing a single source of truth for all obligations. Furthermore, institutions must Leverage Explainable AI (XAI), guaranteeing that all AI/ML models used for compliance have clear audit trails and explainable decision paths, which is non-negotiable when proving compliance to regulators. Finally, they should automate the compliance lifecycle, utilizing AI and intelligent automation to streamline repetitive tasks, from regulatory change intake through final reporting, thereby minimizing human error and maximizing speed.

3. Foster an Organization-Wide Culture of Compliance

Fostering an effective culture of compliance requires continuous effort. Institutions must implement Training and Education that is continuous, engaging, and scenario-based for all employees, focusing especially on new regulations (like UDAAP and Data Privacy) and emerging fraud types. Compliance must be actively driven by senior leadership, with the board and executive management clearly defining roles, responsibilities, and accountability for both cyber risk and regulatory adherence. Finally, accessible internal communication is vital; banks need robust channels that allow employees to easily report compliance concerns and quickly access up-to-date policies and procedures.

4. Master Third-Party Risk Management (TPRM) and Operational Resilience

To manage external risks, banks must implement Continuous Vendor Due Diligence. This means applying real-time monitoring and strict Service-Level Agreements (SLAs) to all cloud providers and FinTech partners to guarantee they consistently meet the bank's security and regulatory standards. Additionally, institutions must perform rigorous scenario testing, regularly checking their operational resilience frameworks against various major disruptions such as a cloud outage or a crippling cyberattack to prove they can recover critical operations within acceptable tolerance limits.

5. Embrace Digital Trust and Data Governance

To secure data integrity, banks must prioritize Data Lineage and Quality, ensuring that all compliance data (such as KYC files and transaction logs) is accurate, timely, and fully traceable back to its original source. Simultaneously, institutions must establish ethical AI governance by setting up an internal ethics board or committee. This body is specifically tasked with overseeing the development and deployment of AI to identify and mitigate algorithmic bias, ensure model transparency, and guarantee adherence to emerging global AI regulations.

Conclusion

Banking compliance is no longer sustained by scale alone. As regulatory expectations expand across data, technology, and risk domains, banks need compliance models that are built for coordination, adaptability, and continuous oversight.

Institutions that continue to operate with fragmented processes and manual controls will find it increasingly difficult to manage regulatory complexity efficiently or maintain supervisory confidence. The path forward lies in treating compliance as a strategic capability supported by integrated systems, informed risk prioritisation, and disciplined governance.

By adopting unified, technology-led compliance frameworks, banks can strengthen regulatory alignment while operating with greater clarity, consistency, and control.

Frequently Asked Questions

1. Why is AI governance becoming a top priority for banks?

As banks integrate AI for fraud detection and lending, regulators require these models to be explainable and unbiased. AI governance ensures that automated decisions are fair and can be defended during a regulatory audit.

2. What is the difference between traditional compliance and RegTech?

Traditional compliance relies on manual checks, periodic audits, and reactive monitoring. RegTech (Regulatory Technology) uses AI, automation, and big data to provide continuous, real-time oversight and predictive risk management.

3. How does regulatory fragmentation affect international banks?

Fragmentation occurs when different countries have conflicting laws regarding data privacy (e.g., GDPR vs. CCPA) or sanctions. Banks must build flexible frameworks that can adapt to local rules while maintaining a unified global standard.

4. What are false positives in AML, and how does AI help?

A false positive is when a legitimate transaction is flagged as suspicious. AI reduces these by analyzing deeper context and historical behavior, allowing compliance teams to focus on actual criminal threats rather than harmless errors.

5. What is the role of ESG in banking compliance?

Environmental, Social, and Governance (ESG) compliance requires banks to report on how climate change and social issues affect their portfolios. Failure to report accurately can lead to "greenwashing" penalties and loss of investor trust.