Quick Summary: India’s data privacy framework spans multiple laws and regulatory authorities that govern the handling of personal data across sectors. Different regulators influence how organizations approach data storage, security controls, and accountability. Compliance challenges commonly arise from operational complexity, regulatory interpretation, and data movement constraints. This article outlines the regulatory landscape, key challenges, and considerations for managing data privacy in India.

India's data privacy scenario is shifting rapidly, and businesses must treat compliance as a core responsibility. Organizations that collect, process, or store customer data carry a significant obligation to protect it. When customers share their personal information, they place trust in an organization’s ability to safeguard it. A single data privacy lapse can quickly damage credibility and business standing.Meeting India’s data privacy requirements can be challenging. With the Digital Personal Data Protection Act (DPDPA) in force since 2023, along with sector-specific guidelines and developing enforcement practices, the compliance framework is layered and complex. For many organizations, identifying the right starting point can be difficult.

This article below explains why data privacy compliance matters for Indian businesses, outlines the current regulatory environment, and provides practical steps to help organizations protect customer data while reducing compliance risks.

Why Data Protection Matters?

The exponential growth in data collection and processing has placed data privacy at the center of business and regulatory discussions worldwide, with its impact especially pronounced in India. As digital interactions increase, defining and enforcing clear standards for handling personal and sensitive information has become essential for maintaining social trust and economic stability.

One of the most critical reasons why data privacy is non-negotiable in India stems from its constitutional backing. Privacy is not just a policy matter but a fundamental right recognozed under the Indian Constitution. As a result, protecting personal data is, closely tied to protecting individual liberties. Failures such as data breaches or unauthorized access can have serious consequences for individuals, including identity theft, financial fraud, and potential misuse that infringe upon their freedoms and dignity.

Alongside legal considerations, strong data privacy practices are critical for sustaining trust in India’s digital economy. When customers are confident that businesses handle their personal data responsibly and comply with regulations, they are more willing to use digital services and share required information. In contrast, privacy incidents can quickly weaken customer trust, harm brand reputation, and result in regulatory penalties.

Ultimately, compliance with India’s data protection framework is both a legal and ethical responsibility. By proactively prioritizing security and transparency, businesses cultivate a culture of responsible data governance. This commitment not only ensures the firm meets its legal duties but also contributes directly to the development of a secure, transparent, and privacy-conscious digital society, safeguarding the interests of all stakeholders.

Who must comply with India’s Personal Data Protection Laws?

India’s data protection framework applies to organizations based on how they collect, process, or manage personal data, as well as their link to individuals located in India. Compliance obligations extend to the following categories of entities:

Data Fiduciaries

Data Fiduciaries are the entities, both organizations or individuals, decide why personal data is collected and how it is processed. Because they determine the purpose and method of processing, they carry primary accountability for protecting the data of individuals, referred to as Data Principals.

Examples of Fiduciaries include businesses collecting customer information, government agencies maintaining citizen records, or a non-governmental organization (NGO) managing beneficiary data. Their decisions data usage, storage, and processing directly activate applicable data protection requirements.

Data processors

Data Processors handle personal data strictly on the instructions of a Data Fiduciary. They do not decide the purpose or method of processing but carry out operational or technical activities related to data handling. Their obligation is to ensure they implement sufficient security measures and comply with all instructions provided by the Data Fiduciary under a contract or agreement.

Overseas Entities

India’s data protection law applies outside national borders in specific scenarios. Organizations located outside India are required to comply when they process the personal data of individuals based in India in connection with:

- Offering goods or services to individuals in India

- Profiling individuals located in India

- Conducting targeted monitoring or similar activities involving individuals in India

This ensures that location alone does not exempt entities from compliance obligations when Indian residents are involved.

Individual Data Controllers

Individuals who process personal data as part of professional or commercial activities are also covered under India’s data protection laws. This applies to self-employed professionals, sole proprietors, and others acting in a business role.

The distinction lies between professional use and purely personal or household use. When personal data is handled for work-related purposes, the same standards of care, security, and compliance apply as they do for larger organizations.

Government Authorities

All government bodies and public authorities, at both the central and state levels, are subject to data protection requirements when handling personal data. Similar to private Data Fiduciaries, they are expected to follow principles of lawful, fair, and transparent processing.

At the same time, the law allows specific exemptions for government processing in defined circumstances, such as matters relating to national security, public order, or other legitimate state functions permitted under the Act.

Key Data Privacy Laws and Regulations in India

India’s data privacy framework consists of central legislation, sector-specific regulations, and cybersecurity directives that together govern how organizations collect, process, and protect personal data. Depending on the industry and nature of operations, businesses may be subject to requirements issued by multiple regulatory authorities.

The core of Indian data privacy regulation is the Digital Personal Data Protection (DPDP) Act, 2023. However, compliance involves a broader regulatory ecosystem comprising rules and directives from sectorial regulators and the national cyber security agency.

Digital Personal Data Protection Act, 2023 (DPDP Act)

The DPDP Act is India’s primary law governing how personal data is collected, stored, and processed. It sets out core requirements such as lawful and consent-based processing, purpose limitation, and defined rights for individuals over their personal data.

The Act applies to organizations operating in India as well as foreign entities that handle the personal data of individuals located in India. It does not mandate blanket data localization, but cross-border transfers are permitted only to countries notified by the Government of India. Non-compliance can lead to substantial financial penalties, making structured data governance essential.

Reserve Bank of India (RBI) Regulations

RBI regulations impose strict data handling and localization requirements on the financial services sector. Under the Payment Data Localization mandate, payment system operators such as banks, fintech firms, and payment gateways must store payment-related data within India.

This includes transaction details, customer information, and payment credentials. Limited processing outside India may be allowed for specific operational needs, such as fraud detection, provided a full copy of the data remains stored in India. These requirements support regulatory oversight of critical financial systems.

IRDAI Regulations

IRDAI governs data protection practices within the insurance sector. Insurers and intermediaries are required to safeguard policyholder information, maintain confidentiality, and apply appropriate security controls when handling personal data.

Its guidelines also cover outsourcing arrangements, IT systems, and data retention, placing responsibility on insurers to ensure customer data is managed securely and in line with regulatory expectations.

SEBI Cybersecurity Framework

The SEBI Cybersecurity Framework sets mandatory security requirements for entities operating in the securities market, including stock brokers, mutual funds, depositories, and portfolio managers.

Regulated entities are classified based on risk and Assets Under Management (AUM), with corresponding obligations covering cybersecurity policies, technical controls, incident response, and regular security assessments. Vulnerability Assessment and Penetration Testing (VAPT) of critical systems is a key requirement.

CERT-In Directives

CERT-In directives define mandatory cybersecurity obligations under the Information Technology Act, 2000. These include time-bound reporting of cyber incidents and extended system log retention requirements.

They operate alongside Section 43A of the IT Act and the IT (Reasonable Security Practices and Procedures) Rules, 2011, which establish liability for inadequate protection of sensitive personal data. Together, these measures strengthen incident response and accountability across sectors.

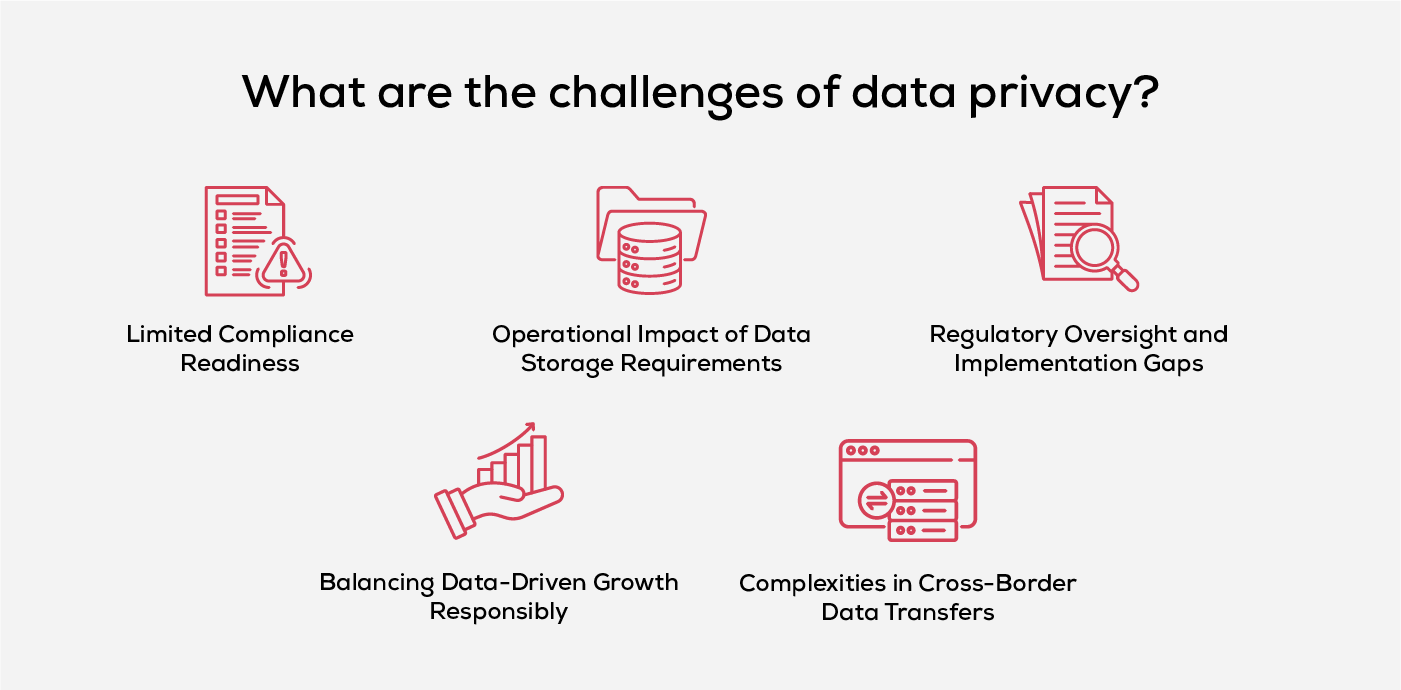

Challenges in Ensuring Data Privacy

Despite the enactment of comprehensive legislation like the Digital Personal Data Protection (DPDP) Act, 2023, India's journey toward effective data privacy management faces several critical challenges, particularly concerning implementation and the integration of global business practices.

Limited Compliance Readiness

For many Small and Medium Enterprises (SMEs), limited awareness of DPDP Act obligations directly increases compliance risk. When organizations do not fully understand their responsibilities under the law and related sectoral rules, privacy controls are often incomplete or inconsistent. This results in delayed compliance, exposure to penalties, and reactive spending on training, process redesign, and infrastructure upgrades that could have been planned more efficiently.

Operational Impact of Data Storage Requirements

Sector-specific data storage requirements create tangible operational and financial strain for organizations with distributed or global systems. While the DPDP Act does not mandate blanket localization, regulatory obligations in certain industries require defined categories of data to be stored within India. For multinational businesses, this can lead to duplicated infrastructure, fragmented data environments, and higher compliance costs, particularly when existing systems rely on centralized or cross-border architectures.

Regulatory Oversight and Implementation Gaps

The effectiveness of India’s data protection framework depends heavily on consistent enforcement and regulatory oversight. The Data Protection Board of India (DPBI) is responsible for implementing and enforcing the DPDP Act, yet its capacity, independence, and operational readiness will directly influence how compliance obligations are interpreted and enforced. Any lack of clarity or consistency in enforcement increases uncertainty for businesses and complicates long-term compliance planning.

Balancing Data-Driven Growth Responsibly

Advanced technologies such as artificial intelligence and data analytics depend on large volumes of high-quality data. Strict privacy requirements, if not clearly operationalized, can restrict how organizations design and deploy such use cases. Businesses face the risk of slowing product development or limiting analytical capabilities if privacy controls are not aligned with data usage needs, affecting competitiveness in data-driven markets

Complexities in Cross-Border Data Transfers

Cross-border data transfers introduce ongoing legal and operational risk for organizations operating across jurisdictions. Although the DPDP Act allows transfers to government-notified jurisdictions, companies must still align Indian compliance requirements with the data protection laws of partner countries. Managing these overlapping obligations increases complexity, raises the risk of non-compliance, and often requires additional legal, contractual, and technical controls.

Conclusion

India’s data privacy framework continues to take shape through a combination of regulatory guidance, sectoral expectations, and practical experience. As clarity improves and implementation practices settle, organizations are likely to place greater emphasis on consistency, transparency, and accountability in how personal data is handled. Over time, thoughtful collaboration between businesses and regulators may help create compliance approaches that are easier to adopt, supportive of responsible data use, and aligned with India’s broader digital ambitions.

Frequently Asked Questions

1. Why is user consent important under India’s data privacy framework?

India’s data privacy framework requires organizations to obtain clear and informed consent before processing personal data. Consent must be given freely and with a proper understanding of how the data will be used. This increases transparency and places greater responsibility on businesses to clearly communicate their data practices to individuals.

2. How do the Information Technology (IT) Act, 2000, and data protection laws work together?

The IT Act, 2000 provides the legal foundation for digital activity and cybersecurity in India, including liability for negligence in protecting sensitive information. Data protection laws build on this foundation by focusing specifically on how personal data is collected, processed, and protected, creating a more structured and focused privacy framework.

3. How are children’s personal data protected in India?

Children’s data is subject to stricter safeguards. Organizations must obtain verifiable consent from a parent or legal guardian before processing a child’s personal data. The framework also restricts practices such as tracking or profiling children in ways that could cause harm, placing a higher duty of care on businesses.

4. What role does the Data Protection Board of India play in enforcement?

The Data Protection Board of India is responsible for handling non-compliance and adjudicating penalties under the data protection framework. Its role is to provide a structured mechanism for enforcement and grievance resolution, bringing greater consistency to how data protection obligations are applied.

5. What is the difference between a Data Fiduciary and a Data Processor?

A Data Fiduciary decides why and how personal data is processed and carries primary legal responsibility for compliance. A Data Processor handles personal data on behalf of the Fiduciary and must follow documented instructions. This distinction is important because it determines where accountability and legal obligations rest.