- Core Banking Solution - Finacle

- Payment Suite for Government Business

- Business Intelligence Solutions

- Application Development and Maintenance Services

- Artificial Intelligence

- Robotic Process Automation Solutions

- Multi-Function Banking Kiosk

Payment Suite for Government Business

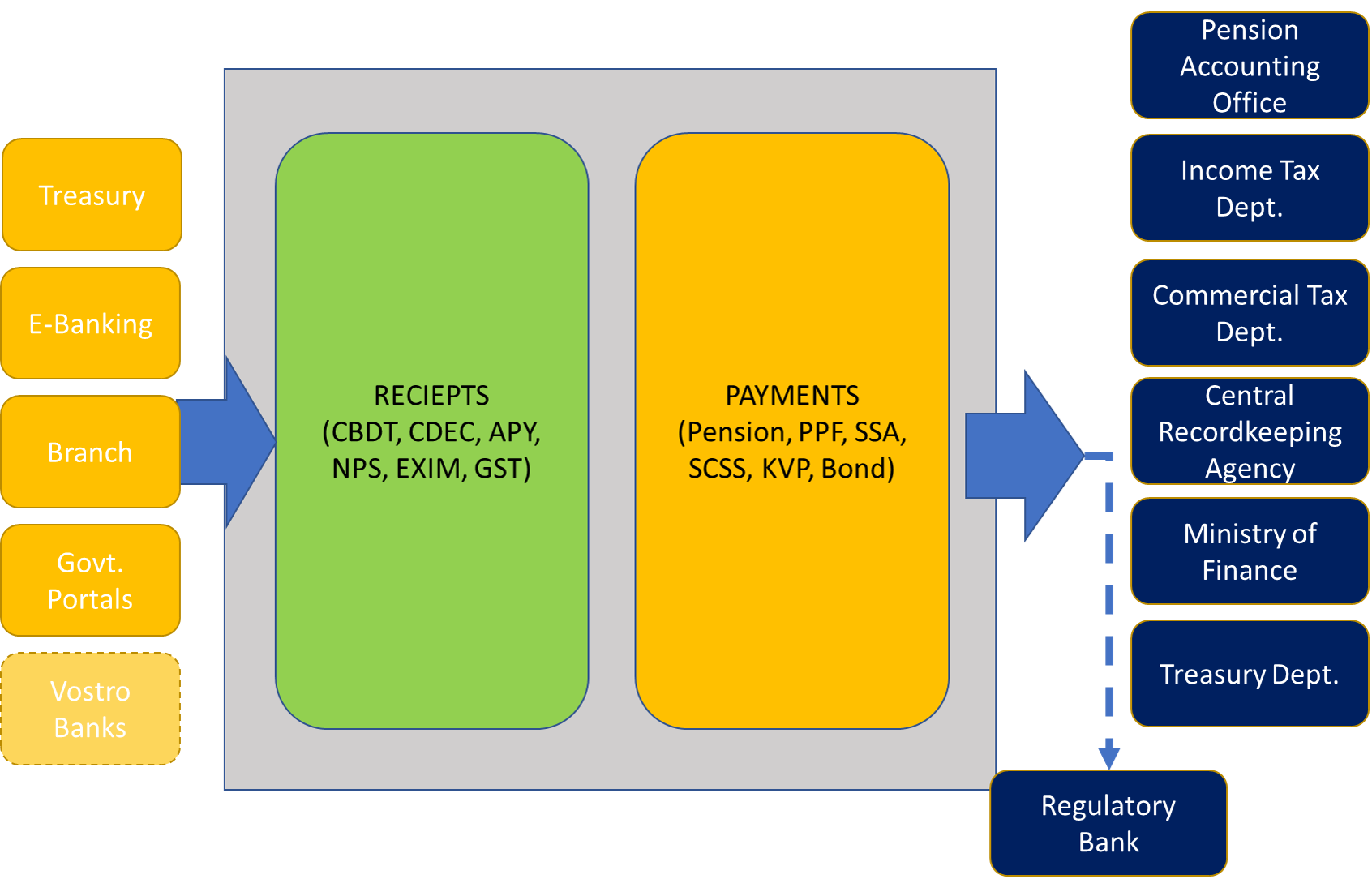

Over 25 public and private sector banks in India are successfully conducting government business operations using our in-house developed IP Solution. ISL Government Business Suite (GBS) is an e-Governance solution that handles various types of financial transactions on behalf of the Government for Organizations / Banks. This product can be parameterized, which provides flexibility in functionality for banks to adapt to Government Guidelines.

Our GBS addresses the collection and payment requirements in a cost-effective way. It is a centralized web-based solution and can be integrated with any banking solution or can be used as a separate stand-alone application.

Key Modules of Government Business Suite

GBS - Tax Collections

GBS Tax Collections module takes care of different types of tax collection and remittance by authorized banks in India such as:

- Direct taxes falling under the Central Board of Direct Taxes (OLTAS – On-Line Tax Accounting System)

- Indirect taxes falling under the Central Board of Excise and customs (EASIEST – Electronic Accounting System In Excise and Service Tax)

- State Government’s concept of Sales Tax

- Customs Duty Collections including Duty Draw Back Payments through Electronic Data Interface (EDI - Export and Import - EXIM) directly with Customs office

It handles funds flow as under:

- All Tax collections by the Dealing / Collecting branches daily

- Transfer of all collections to a pooling / centralized location as defined by the bank, on the same day

- Transfer of funds to the Government

GBS - Savings schemes for Public

GBS Savings Schemes for Public module takes care of the various Savings and Thrift Schemes promulgated by the Government from time to time for inculcating the habit of savings amongst the public. The same software can be suitably amended/modified to make it compatible with global conditions based on the requirement. For example, we are handling the following schemes in the Indian Government environment:

Public Provident Fund Scheme (PPF) - This module takes care of the Subscriptions, Withdrawals, Loans, Agency Commission features, Interest calculations, Penalty, Remittance of Funds, etc., governing the Funds with validations and checks in accordance with the rules and also provided to transfer the accounts across the branches of the bank.

Relief and Savings Bond Scheme (Bonds) - The various Relief and Savings Bonds (cumulative and non-cumulative) that are in force can be handled in the module with all the validations as per the rules, closure, interest process, communication to bondholders, remittance of funds to Government Central Accounts Department and so on.

Senior Citizen Savings Scheme (SCSS) - This module takes care of the Subscriptions, Withdrawals, Premature Withdrawals, Agency Commission Features, Interest Calculations, Nominations, Remittance of funds, etc., with validations and checks in accordance with the rules.

GBS - Pension Schemes

This module provides the solution for regular pension payments to various Government Department Pensioners, for departments like Civil, Defence, Railways, Telecom, State Government, etc., wherein one of the vital functions which the banks have been assigned to handle with ease, thereby serving the respective pensioners.

The Pension Module is a comprehensive solution with all the parameters and validations as applicable to each type of pensioners as also inbuilt provisions to define and handle the various parameters/components as per the respective Government regulations. The processing and payment can be done at a centralized location or through the paying branches and the MIS (Management Information System) reports can be generated as per the requirements of the concerned departments. The system has provisions to define all the government rules for payment of pension.

Benefits of Government Business Suite

Web-enabled Software - GBS is a complete web-enabled software that can be used through the Internet or Intranet.

Extensive support to various Government Transactions - GBS supports various Government Transactions namely, Personal and Corporate Tax Collections, various Deposit Schemes, Pension etc., related to different departments.

Offers quick and easy solution - GBS offers banks to handle Government transactions in a quick and easy way, leading to a significant increase in turnover of Government Business, which in turn paves way for higher earnings in Government Business.

Accurate Calculation / Processing - GBS assures accurate calculation and processing for Government transactions related to Pension and Savings Schemes based on the parameters set.

Supporting Transfer of Funds - Collections made by the Dealing / collecting branches are transferred to the pooling center or centralized location automatically during the End of Day process, daily. The remittance of funds to the Government is done by GBS.

Supports Consolidation of Data and funds - Data and funds consolidation takes place automatically based on the mapping of the branches to various levels. GBS takes care of consolidation on the following scenarios:

- Branches, which are computerized, but not in the centralized environment

- Branches, which are neither computerized nor in the centralized environment (i.e. Manual branches)

Supports Agency Commission Calculations, Claims, Receipts and Distribution - GBS calculates the amount of agency commission that the bank should get from the Government for the Government Business Transactions handled for various schemes for a given period. The facility is provided to make a claim to the Government, for the commission to be received, receives the claim amount and distributes the same to the branches as per the percentage defined.

Supports Interest Calculations and Payments - In the case of Savings Schemes, GBS calculates Interest amount to be paid for each deposit account as per the parameters defined (Interest percentage and periodicity of interest to be calculated) and pay the same. Also, it facilitates to generate relevant reports to claim for the total amount of interest paid, from the Government.

Facilitates Processing and Payment of Pension - Based on the parameters defined for each Government department and the details captured for each pensioner, GBS does processing and arrive at the amount to be paid to each pensioner, taking into account the recoveries to be effected, if any. Once processing is over, GBS makes payment by crediting the pension amount to the respective operative account of the pensioner. Reports in various formats can be generated to claim the total pension amount paid, from the Government. Also, Reports can be customized as per the requirement of the bank or the Government.

Plenty of Inquiries in each Module of GBS - GBS offers a variety of Inquiries to suit different transactional needs of the banks for getting the required information anytime.

Improves efficiency and reduction in cost - Since GBS is a comprehensive solution meeting out all the requirements of the Government, it definitely improves efficiency thereby reducing the operational cost and saves a lot of time.

Quickly adapts to changes / new regulations announced by the Government - As GBS is highly parameterized, any new changes / new regulations announced by the Government from time to time are taken care of without any loss of time.

Supports all modes of banking transactions - GBS handles all modes of banking transactions, such as cash, transfers, and clearing.

Integrated software or as a stand-alone application - GBS offers the unique advantage of using the software either as an integrated application or as a stand-alone application. If the bank is already equipped with a centralized banking solution, GBS can very well be integrated with it. Otherwise, GBS can be used as stand-alone software without compromising any of its features.

Defining hierarchy based on requirements - GBS provides branch mapping to any hierarchy as per the requirements of the bank / Government. This will be useful for the transfer of funds, data consolidation, and reports generation.

MIS Reports / Formats as per requirements - GBS provides a lot of MIS reports which caters to the needs of various Government departments. Also, various formats such as Account Opening forms for Savings Schemes, Life Certificate, and Undertaking letter for Pension Module are inbuilt features which are available for immediate use.

Platform Independent - GBS software is compatible with any platform like HP - UNIX, SUN Solaris, IBM AIX platform, MS-Windows, etc. Thus, it has a flexible architecture that can be implemented in any kind of server environment.

Supports ISO 8583 for Message Control - GBS software is compatible with common standards used in the banking industry, including ISO 8583 for message control.

Easy Upgradation / Migration - Upgradation / Migration of GBS software from the existing version to a higher version can be done with the least possible time, using the scripts.